Rising battery fires cloud electric vehicles’ future

OPINION:

Contributing to the slowing sales of electric vehicles in the United States and Europe are growing concerns about the safety of their lithium-ion batteries, which can spark spectacular fires, quickly engulfing the vehicle in flames and smoke and spewing toxic fumes.

The internet is awash in videos of EVs going up in flames in tightly packed underground parking garages.

Other incidents include a factory fire in South Korea that killed 22 workers and blazes at battery-recycling centers in Scotland that required extensive firefighting efforts, Steve Goreham noted in The Wall Street Journal. And in New York, e-scooter fires resulted in 270 blazes last year, which claimed 18 lives.

Across the pond, a recent freedom of information request from the insurer QBE found that EV battery fires in the U.K. jumped 46% last year, DailySkeptic.com reported.

“Car and bus fires were up 33% and 22% respectively and it is noted that there are now three battery fires per day compared with two in 2022,” DailySkeptic.com said.

“Battery-powered vehicles account for a small share of car fires, but controlling EV fires can be difficult,” a 2023 Clemson University analysis notes. “Typically, an EV fire burns at 5,000 degrees Fahrenheit (2,760 Celsius), while a gasoline-powered vehicle on fire burns at 1,500 F (815 C). It takes about 2,000 gallons of water to extinguish a burning gasoline-powered vehicle, putting out an EV fire can take 10 times more.”

EV batteries can ignite for several reasons, including a crash with another vehicle, overheating or external or internal short-circuiting. In all three cases, the resulting fire can result in the total loss of the vehicle. The Clemson analysis acknowledged that EV battery fires are “a growing public safety concern.”

It’s no wonder that insurance premiums for EVs are higher than those for conventional vehicles. According to the National Association of Insurance Commissioners, insuring an EV can cost as much as 20% more than insuring a gas-powered car, CNBC reported.

Teslas are among the costliest EVs to insure. A MoneyGeek analysis found that four of the five EVs with the highest insurance premiums were Teslas.

As more EVs go on the road (albeit slower than the industry’s backers had hoped), the number of battery fires will likely grow. According to the auto industry tracker Edmunds, EVs accounted for 6.8% of new-vehicle sales in the U.S. as of this past May.

In other words, despite generous tax credits for qualified buyers, over 93% of new-car purchasers chose gasoline-powered vehicles. This skittishness on the part of the public can probably be traced to EVs’ higher prices and repair costs, limited range, lack of adequate recharging infrastructure and worries about the safety of EV batteries.

Though sales of EVs continue to creep up, the auto industry’s earlier exuberance is yielding to reality.

“Tesla sales are down. Ford is scaling back its EV rollout. General Motors is delaying an electric truck and holding back on its investments in EV battery mining,” The Verge reported in early September.

The situation for European EV makers is even more ominous. Almost one-fifth (19.5%) of EVs sold in Europe last year came from China, a figure that is expected to rise to 25% by the end of 2024, according to an analysis by Transport & Environment.

While most of those cars were manufactured by Tesla, Dacia and BMW in China, Chinese brands are forecast to garner 11% of the European market this year, rising to 20% in 2027, the analysis said. In a bid to throw a lifeline to struggling European automakers, the European Union is slapping import tariffs on Chinese brands. The Biden administration announced tariffs on Chinese EVs and other projects in August.

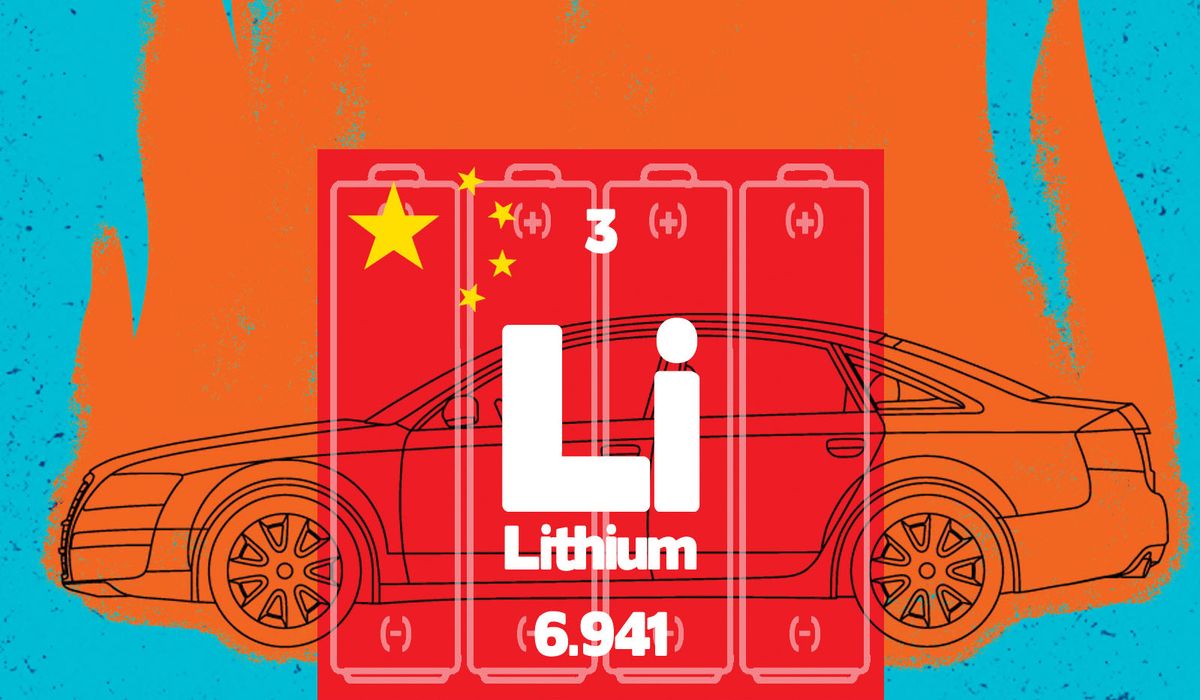

Brussels and Washington’s efforts to shield their respective EV manufacturers from Chinese competition cannot overcome one harsh reality: China’s iron grip on the EV global supply chain. According to a Sept. 17 House Energy and Commerce Committee report, China accounts for approximately two-thirds of global EV battery-cell production, while the U.S. manufactured just 7% as of 2022.

In other words, most of the raw materials in the batteries powering “American-made” EVs are controlled by the government in Beijing. The forced transition to electric vehicles leaves the American transportation sector dangerously reliant on China.

EV battery fires pose a public safety hazard. Even worse, however, are the national security implications of playing directly into the hands of our greatest geopolitical rival.

• Bonner Russell Cohen is a senior policy analyst with the Committee for a Constructive Tomorrow.