Faraday Future Stock Crashes 25% After Withdrawing 2024 Production Guidance

Written by Cláudio Afonso | LinkedIn | X

The California-based electric vehicle (EV) maker Faraday Future published on Tuesday its fourth quarter and full year financial results disclosing that it is withdrawing its production target guidance for 2024.

Shares of the EV startup closed 0.86 percent higher on Tuesday at $1.17 and is currently trading 25 percent lower at $0.875 in pre-market following the release of the financial results.

The company stated that the reason for the decision is the “current market conditions and current levels of funding the company”. In the previous financial update last November, the company said it expected to produce about 1,000 vehicles this year.

As cash reserves risk the future of the EV startup, Faraday Future said that it “continues to pursue additional significant strategic investors”.

NEVER MISS AN UPDATE

“To support future growth the Company continues to pursue additional significant strategic investors to support future growth. It also is considering equipment- and IP-backed financing to potentially reduce reliance on dilutive funding,” the startup said.

“The Company does not plan to issue additional shares unless and until the Company receives shareholder approval to increase total authorized share count,” Faraday Future added.

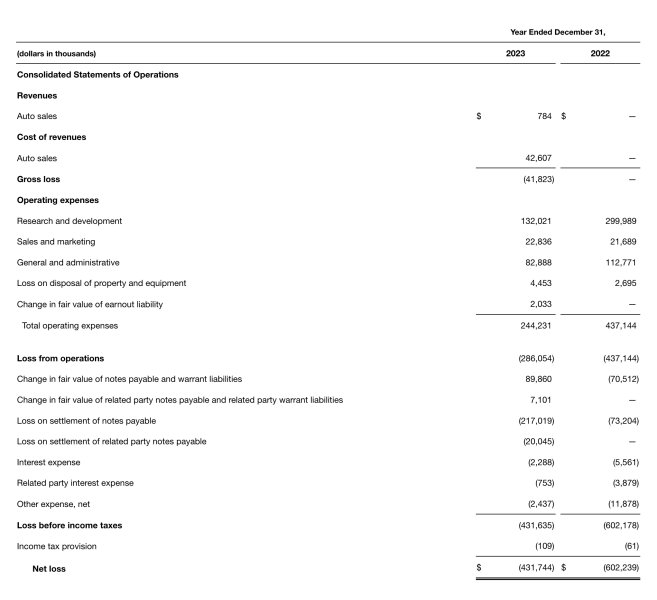

The company disclosed a total of four FF91 EV vehicles sold and six leased for the full year of 2023. The startup recorded a revenue of $0.784 million in that period.

“We began the production of our FF 91 Futurist in March 2023 and started making deliveries to customers in August 2023 and have sold four and leased six vehicles for the year ended December 31, 2023,” the company stated.

“Automotive sales revenue was $0.8 million for the year ended December 31, 2023. We started vehicle delivery to our customers during the third quarter of 2023 and this amount is primarily driven by the four cars that were sold through December 31, 2023. There was no sales revenue for the year ended December 31, 2022,” the company stated.

Research and development expenses in 2023 were $132 million substantially lower than nearly $300 million in the previous year. The company justified the decrease by saying that the reduction is primarily related less activities around engineering, design, and testing services as they were completed in 2022.

NEVER MISS AN UPDATE

“The decrease in R&D expense is primarily due to the reduction in engineering, design, and testing services of $125.9 million as we substantially completed R&D activities related to the FF 91 Futurist vehicle in 2022,” the startup explained.

“Further, as we started production in March 2023, certain costs were recognized as cost of revenue and certain materials purchases were capitalized to inventory versus all being recognized as R&D expense. In addition, there was a decrease in personnel and compensation expenses of $20.2 million due to a decrease in headcount and a decrease in professional services of $15.1 million as part of cost saving measures implemented by us in light of our financial position,” Faraday added.

The company announced on Tuesday that Nasdaq granted an extended stay of the suspension pending a hearing with Nasdaq’s Hearings Panel.

The company has been confronting the possibility of being delisted from Nasdaq due to ongoing non-compliance with several key listing requirements. Over the past six months, the company has received multiple notifications from Nasdaq, highlighting critical issues that threaten its status on the exchange.

NEVER MISS AN UPDATE

Written by Cláudio Afonso | LinkedIn | X