AutoZone: A Great Compounder To Keep An Eye On (NYSE:AZO)

Bruce Bennett/Getty Images News

I consider AutoZone (NYSE:AZO) to be a best-in-class compounder that earns returns on their invested capital in excess of 25%. The management has shown great capital allocation skills by reinvesting on average 20% of the profits back into the core business operations and achieving around 7% growth in sales and operating profit.

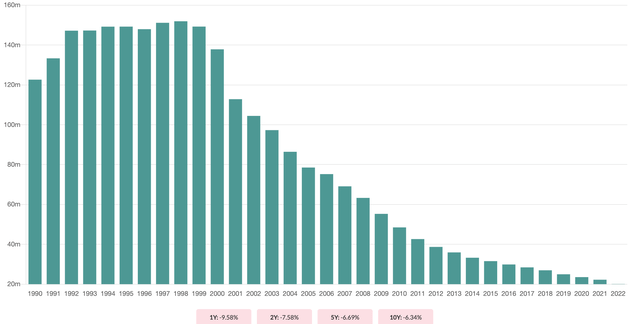

Shares Outstanding: AutoZone (Qualtrim.com)

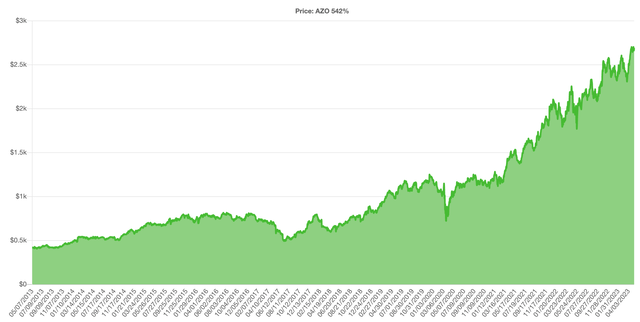

Thanks to returning the other 80% of profits in the form of stock buybacks, the stock appreciation over the last 10 years equalled 542%.

AutoZone stock price return over the last 10 years. (Qualtrim.com)

According to my fair value calculation, the stock is currently trading at a 25% premium to its intrinsic value. I assign the “Hold” rating and recommend waiting for a pullback in the stock price for a better entry point.

Business Overview

AutoZone is a leading retailer and distributor of automotive replacement parts and accessories. It operates in the United States with 6168 stores and in recent years started the expansion into the Mexican and Brazilian markets where it currently has respectively 703 and 72 locations. Each store offers an extensive product line for cars, sport utility vehicles, vans, and light trucks, including hard parts, maintenance items and other accessories.

In 85% of their stores in the United States their offer a special sales program that provides fast delivery of their products to many repair garages, dealers, and service stations. They mainly focus on Do-It-Yourself (DIY) and Do-It-For-Me (DIFM) customers. That is why they offer multiple free services such as the Loan-A-Tool program, which allows their customers to borrow specialty tools that they need for “just a single job”. To establish close relationships with their customers they conduct free diagnostics and related services such as engine check, battery charging and the collection of used oil for recycling.

The management is extremely customer oriented. They are focused on offering well-tailored product selection and prompt service and delivery. Through their website, they offer next-day or same-day home or business delivery. The focus is on matching customers’ needs and offering different value choices in a good/better and best assortment. One of the elements that differentiates AutoZone from its competitors is its line of in-house brands, which include among others the family of Duralast brands.

AutoZone stores are uniform in their appearance and offer consistent merchandising and product mix. They are highly optimized, and the selling space typically takes 90% to 99% of each store’s square footage. In addition to those stores, AutoZone also develops its mega hub strategy. Currently, they have 272 domestic hub stores and 78 mega hubs which carry a much bigger inventory of 80,000 to 110,000 SKUs. Those fulfilment centres are vital elements of the company’s strategy to increase its ability to distribute products on a timely basis to many stores and further expand a product assortment.

Our mega hub strategy has given us tremendous momentum, and we are doubling down.

Jamere Jackson, AutoZone CFO

In my opinion, the way AutoZone conducts its business is extraordinary. The focus on always putting customers first combined with a constant willingness to improve on inefficiencies of which the development of the mega-hub strategy is an example, shows that I as an investor can be very optimistic about their future. In my view, the management is building a logistic network that may contribute to the strengthening of the company’s competitive advantage and is going to be the main driver of future growth.

Revenue Sources

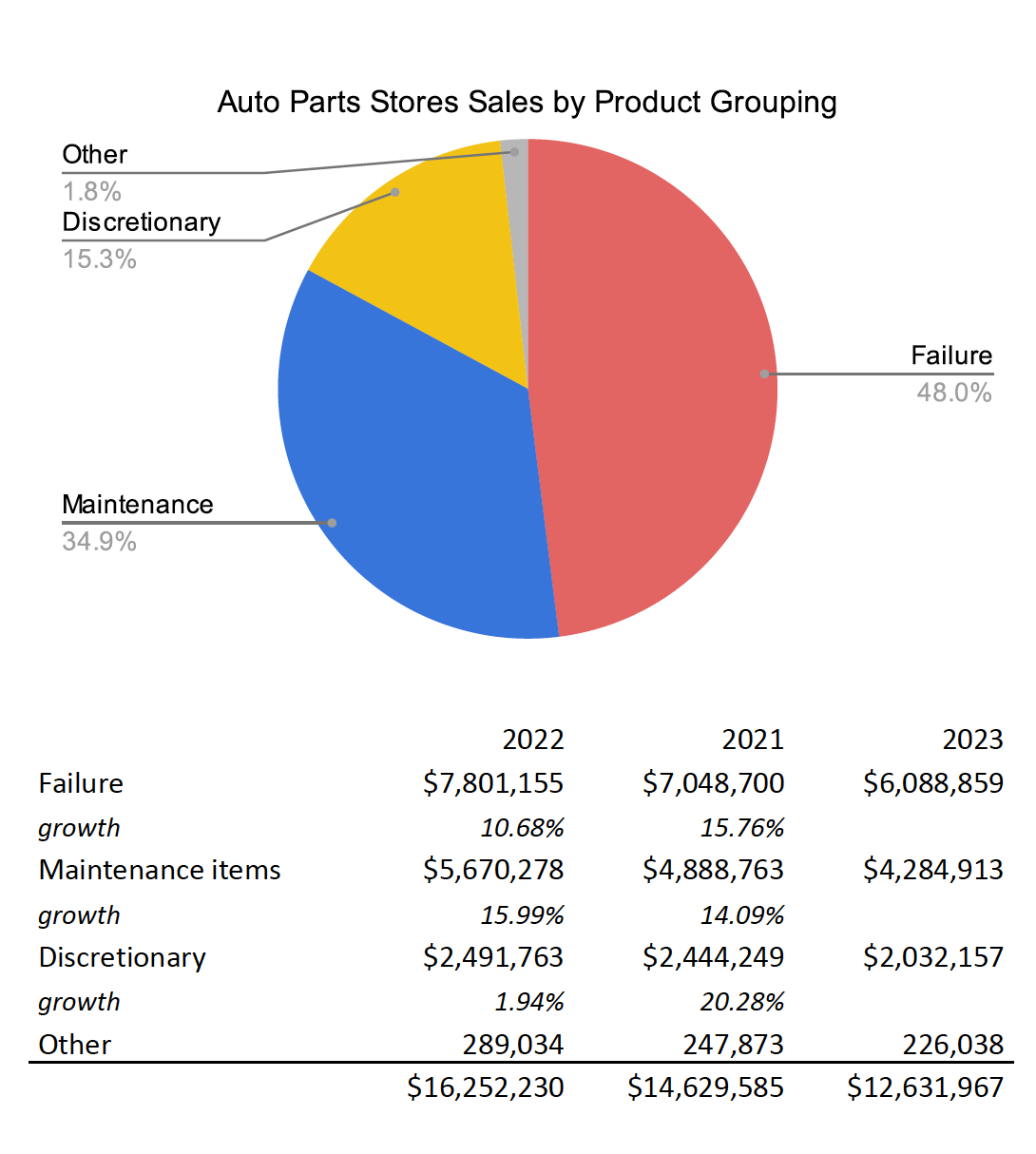

AutoZone’s annual sales mix consists of three main product groupings – failure, maintenance and discretionary. In FY 2022 the first two categories represented the largest portion of the company’s revenue.

AutoZone’s Sales by product grouping (2022 Annual Report)

In the 2022 Annual Report, the management pointed out that in the last year, they noticed a slight decrease in the mix of sales of the discretionary category and a slight increase in the maintenance category. In my opinion, this shows that during higher inflation, as was the case last year, consumers’ priority is to repair their old vehicles not to improve or modernise them. Thus, the revenue in the Failure and Maintenance groups is going to hold stable in a recession and the Discretionary group is more vulnerable to macro factors, and more probable to decline in the case of economic slowdown.

Growth Factors

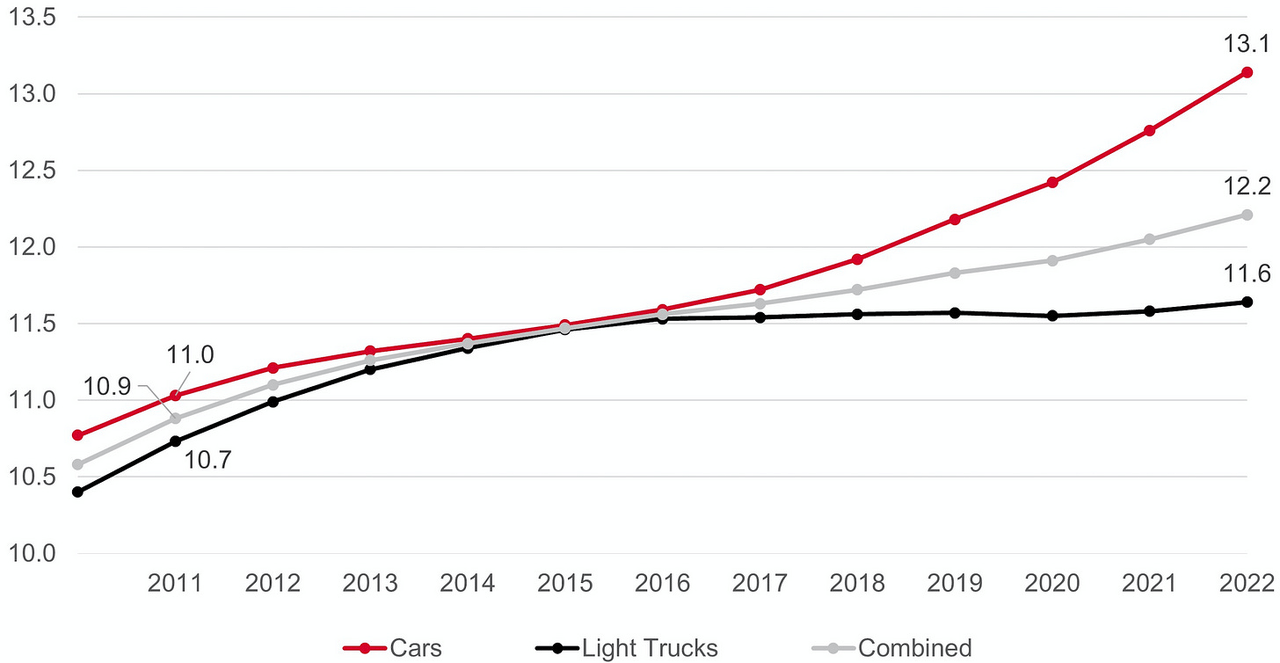

For the retailer, the revenue growth is driven by the annual increases in the same-store sales and new store openings. In FY2023 the company is planning to open around 200 new stores this year and sustain this pace in the future which is going to contribute 3% to the revenue growth. Moreover, the market for automotive retail parts is expected to grow as the average age of all vehicles in the United States recently surpassed 12 years. As the existing vehicles are getting older, they are going to need maintenance. In the Annual Report, they point out that the number of vehicles on the road that are seven years old or more is the first of two main factors that drive the growth of the market. Moreover, it is also the main determinant for opening new stores in a specific location. At this age, the vehicles tend not to be covered by any warranties and increased maintenance is needed to keep them operating.

Average Age of Vehicles in the US (S&P Global Mobility)

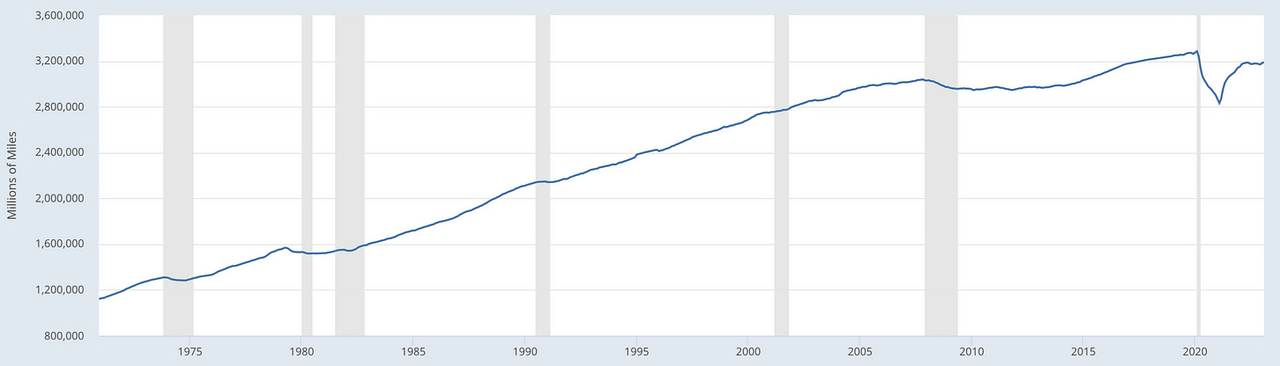

The other crucial factor that closely correlates with long-term market growth for AutoZone is the number of miles driven in the country. The higher this number is, becomes more likely that consumers’ vehicles are going to need service and maintenance which is going to drive the need for automotive hard parts and maintenance items.

Moving 12-Month Total Vehicle Miles Traveled (FRED)

Based on this data, my opinion is that the market for products that AutoZone sells is going to grow 4% annually in the coming decade. In my valuation, I am going to assume that long-term revenue growth for AutoZone is going to equal 7%, where 3% comes from new store openings and 4% from the same-store sales growth driven by the growth in the market for their products.

Competition

The competition in selling automotive parts, accessories and maintenance items in the DIY and DIFM product categories is highly competitive. Numerous factors such as name recognition, product availability, customer service, price and store location are essential to win a customer in this industry.

The competitors include many national, regional and local auto parts chains, wholesale distributors, repair shops and auto dealers and many others. The biggest competitor with comparable store count and square foot sales area is O’Reilly Automotive (ORLY) – a chain created in 1957 that offers specialty automotive parts and repair services similar to AutoZone’s. Other important competitors are Advanced Auto Parts (AAP), Pep Boys, AutoNation (AN) but also Target (TGT) and Walmart (WMT). The good thing about the competition in the automotive retail industry is that the pricing behaviour among all companies is not directed towards lowering prices to wind customers. This issue was mentioned by Jamere Jackson during the 2022 Q2 Earnings Call when he was asked about the impact of wage inflation on the costs and how the company is going to tackle it.

The good news, again, about our industry is that, as we have seen inflationary impacts, whether it’s product cost or it’s wages or it’s freight, I mean, we have typically seen this be an industry that is very disciplined about passing those costs along to consumers and given the relative inelasticity of the demand for our bread and butter products, we expect that to not cause our business to wobble at all.

I view this as a market where there is not only one big winner but in which multiple companies can profit with proper strategy. In my opinion, AutoZone is well positioned with its product offering and distribution channels to harness more market share in the future.

Risks

The most important risk for AutoZone’s business is the trend towards electric vehicles (EVs) and political enforcement to ban the sale of new gas-powered cars in the future. The number of moving elements in electric vehicles is significantly lower than in conventional vehicles and the significant rise in the number of EVs could disrupt the automotive retail industry.

The electric vehicle has one moving part, the motor, whereas the gasoline-powered vehicle has hundreds of moving parts. Fewer moving parts in the electric vehicle leads to another important difference. The electric vehicle requires less periodic maintenance and is more reliable. The gasoline-powered vehicle requires a wide range of maintenance, from frequent oil changes, filter replacements, periodic tune ups, and exhaust system repairs, to the less frequent component replacement, such as the water pump, fuel pump, alternator, etc.

In 2022 less than 1% of the 250 million cars, SUVs and light-duty trucks on the road in the United States were electric. Last year 13.6 million vehicles were sold in the U.S. of which only 5.6% (756,534 units) were fully electric. The RVs sales forecast varies widely due to the uncertainty around local adoption rates, purchase prices and incentives, among many other factors. According to industry analysis by 2035, about 45% of new car sales could be electric. At this rate, about half of the cars on the road would be electric by 2050.

In my opinion, it means that electric cars are not going to be a threat to AutoZone’s future any time soon. The adoption of electric vehicles in the United States is going to take decades and even more time in the countries like Brazil or Mexico where AutoZone is expanding its operations right now.

Profitability

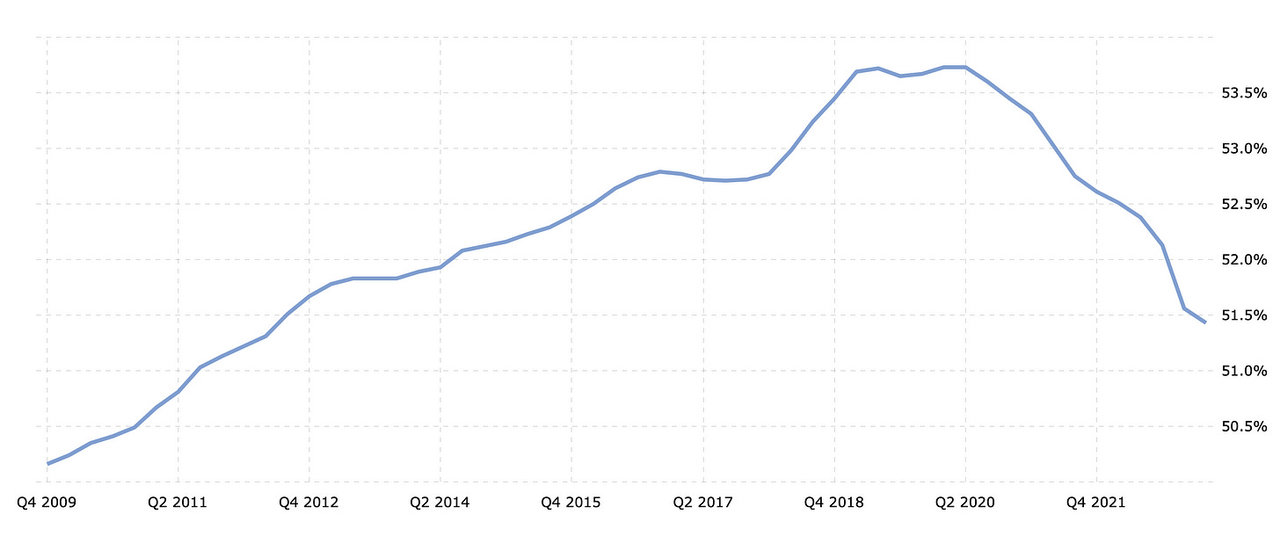

AutoZone has a history of slow and slightly cyclical margin expansion. The gross margin went from 50% in 2010 to 53% in 2020 and recently declined to 51.5%, an effect of the higher Cost of Goods Sold affected by inflation during this period.

AutoZone Gross Margin, 2009-2022 (macrotrends.net)

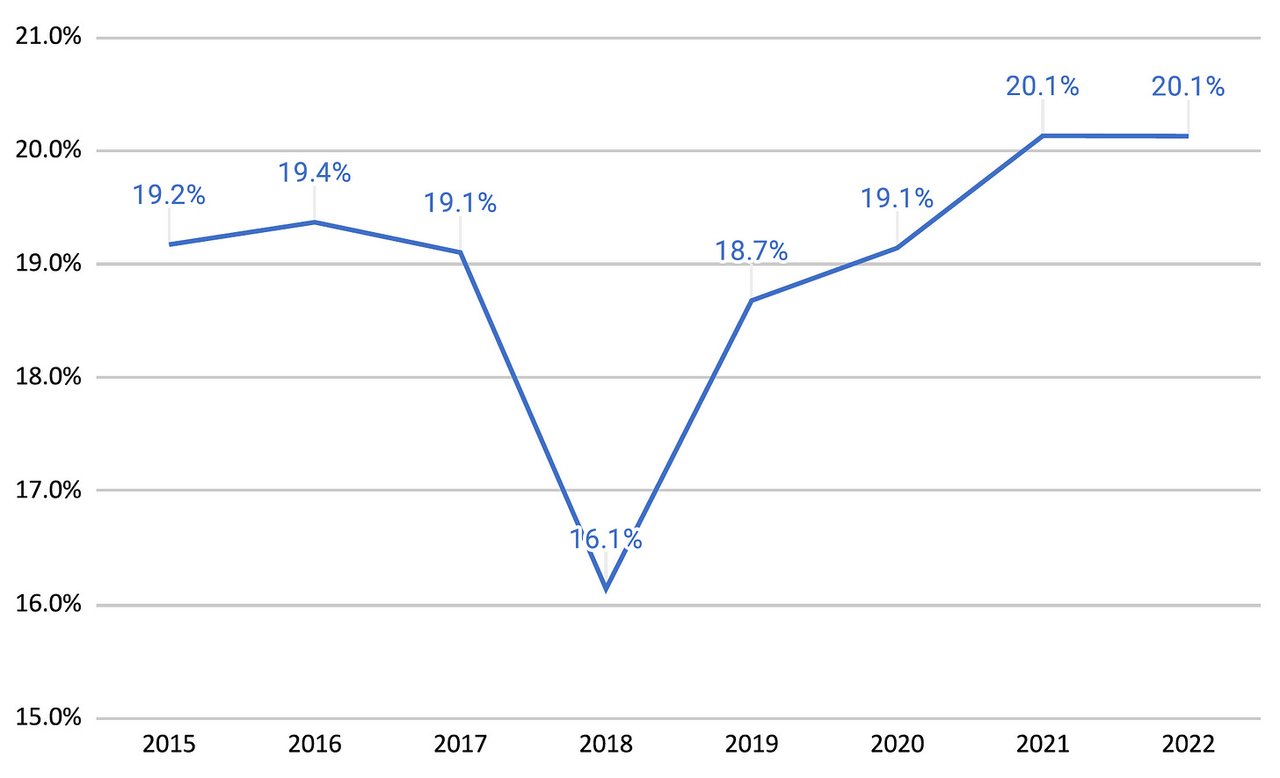

The operating profit margin held stable in the recent two years thanks to well-managed cost control. Over the last 7 years, operating margins were between 18.5% and 20% with only one outlier year in 2018 when the margins were negatively impacted by the pension termination charges and one asset impairment.

AutoZone Operating Profit Margin, 2015-2022 (Author’s Calculations)

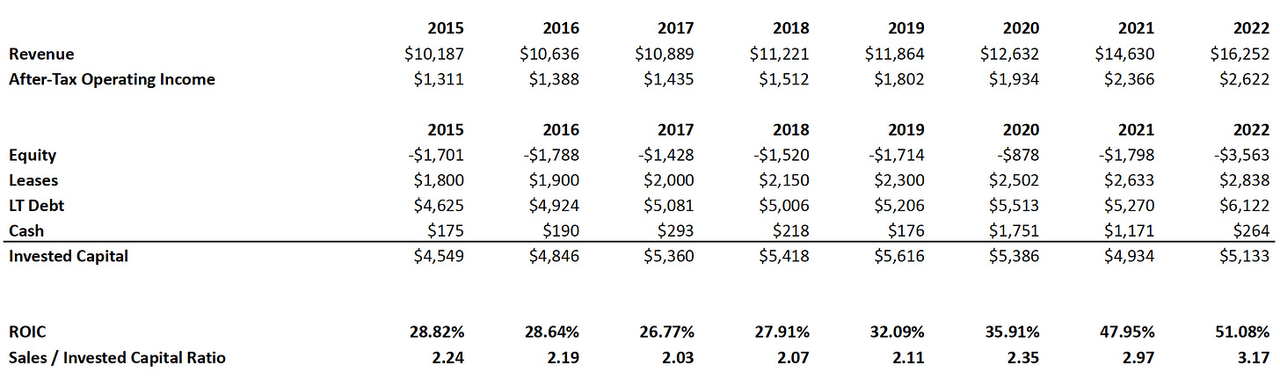

Return on Invested Capital (ROIC) for AutoZone in FY 2022 is an amazing 51%. It means on every $1 invested in the business operation, the company is earning 50 cents every year. This kind of return is rare and signals an extraordinarily well-run business.

Return on Invested Capital calculation for AutoZone. (Author’s Calculations)

In addition, I also calculated a ratio of Sales to Invested Capital that will help me assess how much money AutoZone has to reinvest each year to achieve my forecasted revenue growth in the future.

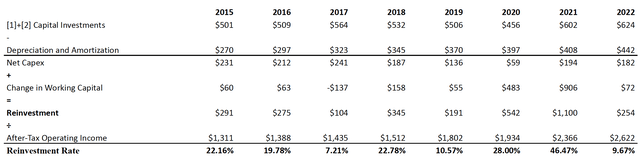

Reinvestment Rate (Author’s Calculations)

Historically, the company reinvested on average around 20% of its profits to fund its growth. The rest was returned to the shareholders in the form of stock buybacks.

Valuation

To value AutoZone I started with forecasting the revenue growth. As already mentioned, I decided to assume seven percent growth over the next 8 years. Growth is going to come from new store openings and market growth.

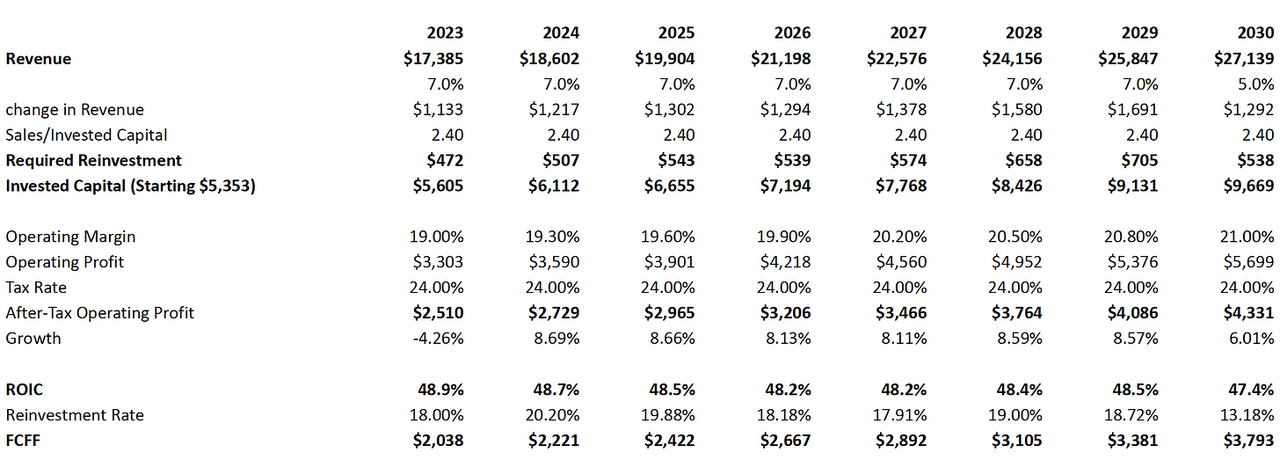

Valuation assumptions for the years 2023-2030 (Author’s Calculations)

In the second step, I calculated the future reinvestment needed for a company. For that, I used the Sales to the Capital ratio of 2.40 and added each year’s number to the next year’s invested capital base.

The third step is crucial because I must decide what the operating profit margins are going to look like in the future. As a starting number, I used 19% which is an average historical margin. I assumed that thanks to new investments in the new distribution centres – mega hubs – an improved economy of scale and lower fixed cost as a percentage of revenue, the operating margin in 2030 is going to be 21%. The numbers for the years between I decided to spread equally. This way I got an Operating Profit each year and applied a 24% Tax-Rate to come up with an After-Tax Operating Profit needed for ROIC and Free Cash Flow calculation.

To get the Free Cash Flow to the Firm (FCFF) number I subtracted the Reinvestment number from the After-Tax Operating Profit. These numbers I am going to use to calculate the fair value of a company.

It is worth noting that ROIC in each forecasted year is in line with historical numbers and that the Reinvestment Rate gradually declines from 20.20% in 2024 to only 13.18% in 2030 as the company matures and the revenue growth slows to 5%. The reinvestments needed to sustain lower growth are going to be lower allowing the company to return a higher percentage of the profits to the shareholders via dividends or stock buybacks.

Fair Value

I discounted the future Cash Flow at the company’s Weighted Average Cost of Capital of 9.91% to calculate a Firm Value of $14,484 million. I subtracted net debt and added the Terminal Value discounted at a lower Cost of Capital of 8.5%, adequate for a mature company.

Discounted Cash Flow calculation for AutoZone. (Author’s Calculations)

Intrinsic Value per Share, as of today is equal to $2,126 compared to the current stock price of $2,692.

In my opinion, the shares are currently overvalued by around 25% and I would recommend putting this company on the watchlist and waiting for a better entry price. Within the last year the shares traded as low as $1,703, and in the current environment of recession fears it is very probable that at some point the market is going to offer this wonderful company at a discount again. This would be a great opportunity to buy ownership in this great compounder that could stay in your portfolio for many years.