Small Business Lending Index for October Finds Loan Approval Rates Rose

While it’s a good sign that approval percentages continue to climb, we are still far below the levels we saw before the pandemic.

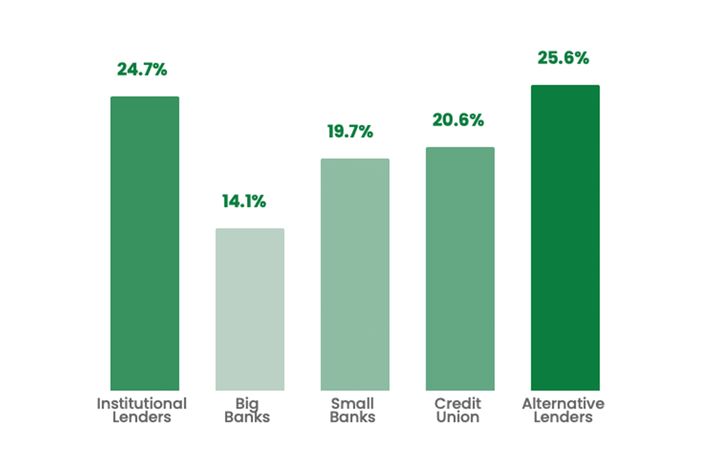

NEW YORK, N.Y. – Small business loan approval percentages at big banks ($10 billion+ in assets) increased from 14% in September 2021 to 14.1% in October. Meanwhile, small banks’ approvals also rose from 19.5% in September to October’s figure of 19.7%, according to the latest Biz2Credit Small Business Lending Index™released today.

“Banks are showing a willingness to lend, but they have been cautious. While it’s a good sign that approval percentages continue to climb, we are still far below the levels we saw before the pandemic,” said Rohit Arora, CEO of Biz2Credit, one of the nation’s leading experts in FinTech and small business lending. “Every category of lender, with the exception of credit unions, which remained flat, saw their loan approval percentages rise this month.”

Nonfarm payroll employment rose by 531,000 in October, and the unemployment rate dropped 0.2 percentage points to 4.6%, according to Jobs Report from the Bureau of Labor Statistics issued Friday, Nov. 5. Notable job growth was seen in leisure and hospitality, professional and business services, manufacturing, and transportation and warehousing. Many of these new jobs are created by small businesses.

“We are seeing an increase in funding requests from transportation and warehousing companies. These industries have rebounded well from the pandemic,” Arora said. “Entertainment-related companies are starting to come back, although restaurants are still hurting. Many small businesses are gearing up for the holiday season and need capital to cover anticipated additional costs.”

Non-Bank Lenders’ Approval Percentages Rise

- Institutional lenders’ approval percentage rose to 24.7% in October, up from 24.5% in September.

- Alternative lenders approved 25.6% of small business funding requests in October, up from 25.4% in September.

- Credit unions approved 20.6% in October, the same as in September, but down from 20.9% a year ago.

Biz2Credit analyzed loan requests from companies in business more than two years with credit scores above 680. The results are based on primary data submitted by more than 1,000 small business owners who applied for funding on Biz2Credit’s platform. To view the report for October 2021, click here.