Report: GM-LG Ultium Cells battery venture to get first federal ATVM loan in a decade

General Motors and LG might be the first companies in 12 years to be awarded a loan under the federal government’s Advanced Technology Vehicle Manufacturing (ATVM) loan program, according to a report from Reuters, citing information from officials.

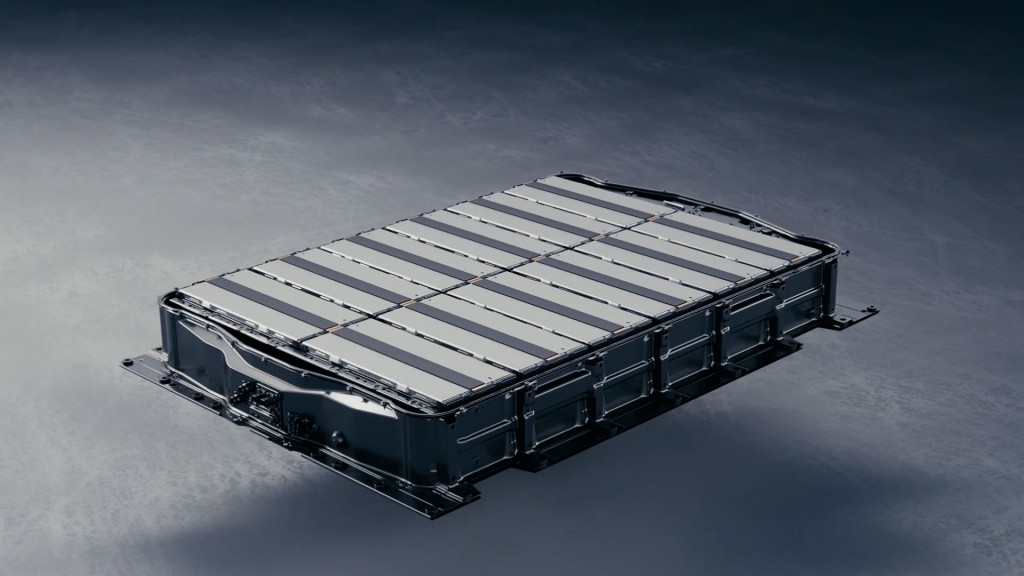

LG Energy Solution and GM have been partners in Ultium Cells LLC, which builds the large-format pouch cells that are the foundation for the automaker’s Ultium EV architecture. Ultium Cells LLC also builds the production plants for scaling up cell production for mass-market EV models. Another venture, with South Korea’s Posco Chemical, will help feed raw materials to the production facilities.

Based on the report, it’s not entirely clear if the ATVM loan might go to Ultium Cells or jointly to the other companies. The ATVM program, overseen by the U.S. Department of Energy, was established under the George W. Bush administration—enabled in 2007 and funded in 2008—to provide low-interest loans to help companies make vehicles with substantially higher energy efficiency than those they replace.

General Motors Ultium batteries

The loan program has $17.7 billion in loan authority and has so far loaned $8 billion. Although it announced that the program had effectively been rebooted in 2014 and pivoted to emphasize suppliers more than automakers, no new loans have been authorized.

GM and LG have encountered some potential bumps in a long supply relationship. Last year, LG agreed to reimburse GM $1.9 billion of the estimated $2.0 billion cost of recalling approximately 140,000 Chevrolet Bolt EVs, which included some complete battery pack replacements.

The ATVM program isn’t necessarily focused around electric vehicles. Ford, for instance, used the largest of these loans so far—$5.9 billion—as a jumping point to produce more of its smaller EcoBoost turbocharged gasoline engines. But the rest of the loans have favored EV or electrification technology. Nissan, for instance, use a loan to establish Leaf production in the U.S.

Tesla is probably the biggest success story of the loan program. It paid off its entire loan, which had been granted in 2009, in May 2013, several years early. It was a touchy subject, at a time when GM and Chrysler were encountering steep financial difficulties, but without it Tesla would likely not have been able to scale up production of the Model S.

Fisker Atlantic Design Prototype – 2012 New York Auto Show

Fisker Automotive was, on the other hand, the highest-profile failure of the program, and one closely intertwined with then-Vice President Biden, who once accidentally laid out Fisker’s product plan. Fisker only received $192 million of its original $529 million loan before it defaulted, with the federal government only eventually recovering a fraction of that.

Although foreign ownership is acceptable, the project must be entirely in the U.S., and applicants must prove is a “reasonable prospect of repayment.”

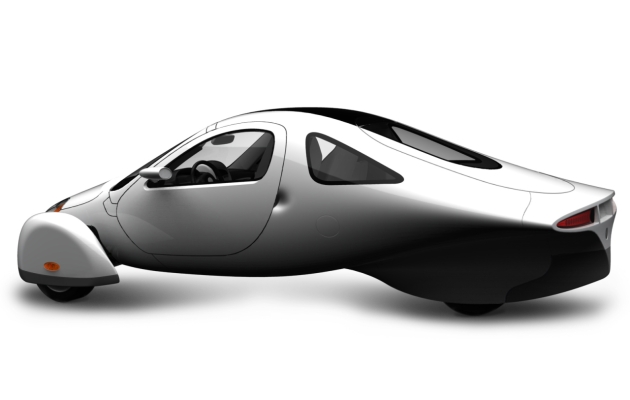

Aptera 2e Production Design

There have been high-profile denials, including the Brammo (electric motorcycles) and Coda Automotive (affordable EVs employing vehicles partly made in China). Aptera (three-wheeled hyper-efficiency car) and Bright Automotive (plug-in hybrid vans) went under before any approval, perhaps answering their own “reasonable prospect” clause.

The GM/LG application wouldn’t be the first in years. Mullen Automotive also reported in April that it has filed an ATVM loan application for electric cargo van production in Mississippi.