New Fintech Program Incentivizes Dealership Service Work

AutoPay+PERKS combines US Equity Advantage’s biweekly loan payment service with an incentive to encourage car buyers to have service work performed at the selling dealership.

US Equity Advantage (USEA) has developed a new enhancement to its AutoPayPlus program designed to help automotive dealers retain service customers and sell additional vehicles, as well as finance and insurance (F&I) products.

Where a dealership gets the money can make a big difference, especially if it’s earned from ongoing service work versus a onetime F&I commission. The service option has potential to bring in far more profitability than a $100 F&I commission.

The company formally rolled out the program Aug. 29 at the 2021 Agent Summit in Las Vegas.

Called AutoPay+PERKS, it combines the company’s biweekly loan payment service with an incentive to encourage car buyers to have service work performed at the selling dealership.

“The two biggest profit centers at any dealership are F&I and service,” says CEO Robert M. Steenbergh. “It is in a dealer’s best interest to encourage car buyers to return to the dealership for maintenance work.”

Yet, for whatever reason, many consumers perceive service performed at a dealership to be more expensive than having work done at an independent service center, he explains. In fact, only 13% of car buyers return to the selling dealership for maintenance work, Steenbergh says.

“But, if a buyer has their vehicle regularly serviced at the dealership, they are 76% more likely to buy their next vehicle from that dealer, too,” he adds.

The situation sparked an idea to incentivize customers to come back for service, which is the foundation upon which USEA built AutoPay+PERKS. Traditionally, whenever someone enrolls in the AutoPayPlus biweekly payment program, the buyer pays a $399 enrollment fee, from which the dealership earns a $100 commission.

Rather than earn a commission at the point of sale, the AutoPay+PERKS program returns the commission to the customer on a prepaid Mastercard that they can only use at that specific dealership. Here, the dealership still earns the money; it just shows up on a different line of the business’ profit-and-loss statement while forging an even stronger relationship with a customer.

“Where a dealership gets the money can make a big difference, especially if it’s earned from ongoing service work versus a onetime F&I commission,” says Steenbergh. “The service option has potential to bring in far more profitability than a $100 F&I commission.”

It’s a relatively new concept called embedded financing, which is part of a broader financial tech industry.

“We can issue a branded Mastercard debit card for the customer that only works at that specific dealer’s location,” says Steenbergh. “We code the cards so they can only work at a specific terminal, such as in that dealership’s service center.”

Incentivizing Dealership Service Work

After a car buyer enrolls their auto loan in AutoPayPlus and has been active for six months – about the time the vehicle needs its first service appointment – AutoPayPlus sends the customer a debit Mastercard co-branded with the dealership’s logo and preloaded with $100 for use at the selling dealership’s service department.

A boost program enables dealers to incentivize customers to add additional funds to the card from time-to-time, which further encourages them to return to the dealership for maintenance work.

For example, after a customer has spent $100 in the dealership’s service department, they can receive a 20% boost on any other funds added to the card, which they can only spend at the dealership. So, by adding $500 to the card, the customer receives a $100 boost from the dealership—but they can only spend the $600 in that dealership’s service department.

“When $100 is loaded onto a debit card that can only be used at the dealership and not at the quick-change oil company down the street, a borrower living paycheck-to-paycheck has no incentive to pay for an oil change out-of-pocket somewhere else,” he explains.

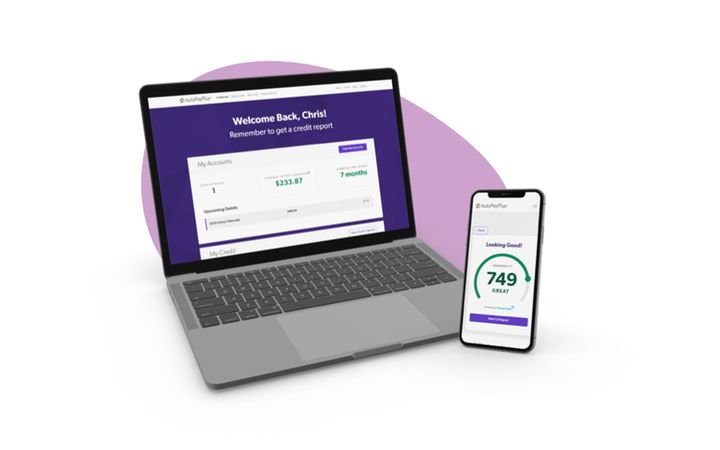

Self-Managed App

A free mobile app co-branded with the dealership’s logo allows customers to manage their AutoPay+PERKS account to:

· Check the balance on their card

· Reload funds to take advantage of in-store specials

· View recall alerts pertinent to their vehicle

· See service scheduling and maintenance reminders

“We make this app available to dealers free of charge to help increase their customer retention efforts without interfering with other programs they may have in place, such as prepaid maintenance,” says Steenbergh. “Best of all, it’s easy and can be cost‐free for dealerships to implement.”

Help for Borrowers

When borrowers are taking out loans for six to eight years, those vehicles will require maintenance at some point, so an extended service contract will be tremendously useful to those buyers, Steenbergh explains. The problem occurs in the perceived cost of adding that contract onto a loan.

“Our research shows about 85% of people are paid biweekly. Yet, when F&I professionals talk about monthly payments, it is confusing to customers who live paycheck-to-paycheck,” he says.

“For example, when buying a new car and learning the payment will be $400 per month for 60 months for just the car, borrowers think they can’t afford that expense because they are thinking they have to take $400 out of the month’s last paycheck, he adds. “But, if you explain that by making a $200 payment every other week, which aligns with their pay cycle, they can buy the vehicle and the extended warranty, many times borrowers will jump at the opportunity.”

By making payments every two weeks rather than once a month, a customer makes the equivalent of one extra monthly payment every year. That not only helps car buyers make their loan payments, but also aids in purchasing add-on products and shortens the trade cycle. They return to the dealership with less negative equity, Steenbergh explains.

“Based on how they live their lives and manage their finances, framing the transaction this way helps ensure buyers can afford all the things they need,” he adds. “In their minds, the borrower is also receiving an extended warranty with no additional out-of-pocket expenditures because nothing in their lifestyle or manner of budgeting changed.”

“Our analysis shows that dealerships sell approximately 57% more F&I products on AutoPayPlus deals versus standard retail deals,” he adds. “Our top dealer groups enjoy a 63% increase in per-vehicle financed income on AutoPayPlus customers.”

Code of Ethics

To help ensure dealers accurately describe the features and benefits of any product offered by US Equity Advantage, the company developed a code of ethics agreement for dealership finance managers. By signing it, they demonstrate a commitment to operating in their customers’ best interests by fully disclosing costs and benefits of the biweekly loan payment service in a clear and simple manner, says Steenbergh.

In addition, the company uses an online exam for F&I professionals to attain certification required to sell AutoPayPlus and AutoPay+PERKS.

“With recent regulatory attention given to biweekly payment products, it is more important than ever that we have practices in place promoting full and accurate disclosure of our products and putting customers’ best interest first and foremost,” he adds.

“USEA is in lockstep with the National Automobile Dealers Association (NADA), which has advised its members to be aware of the specifics of the F&I products they sell and ensure their staff are trained to accurately disclose all fees and costs and not overstate any potential benefits,” says Steenbergh.

For more information about AutoPay+PERKS, visit www.autopayplus.com.

Originally posted on Agent Entrepreneur