Natural Gas, Battery-Electric Vehicles and the Long-Term Future

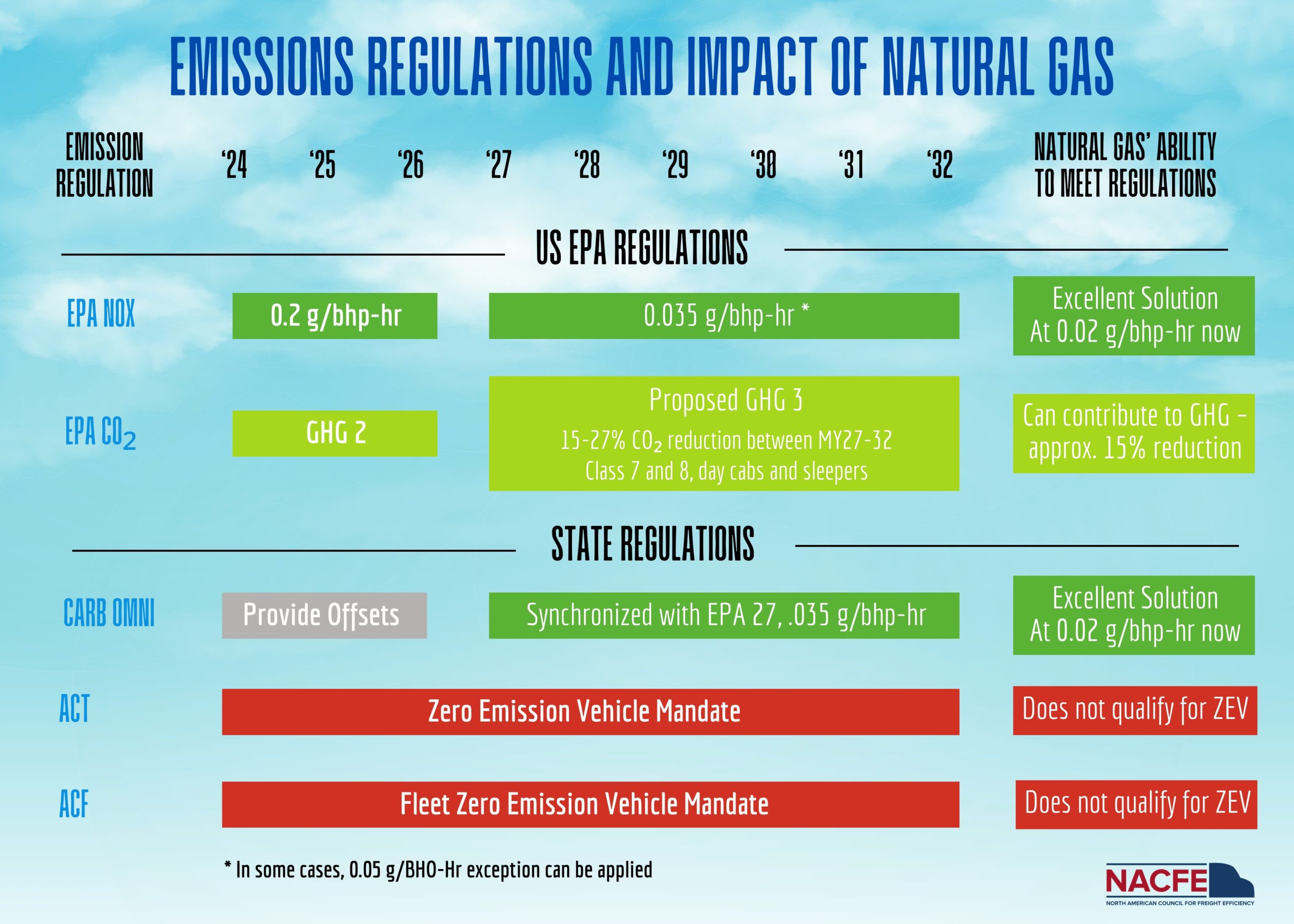

We are certainly entrenched in trucking’s messy middle where fleets have a variety of powertrain options available to them. One option for fleets today is natural gas — especially renewable natural gas. NACFE’s recent report, Natural Gas’ Role In Decarbonizing Trucking, looks at where natural gas fits into the trucking industry and addresses some of the opportunities and challenges fleets will face if they make the move to natural gas.

While we know there are many use cases where battery-electric vehicles (BEVs) make sense — terminal tractors, vans and step vans, medium-duty box trucks, and Class 8 tractors in short regional haul — they are not suited for all duty cycles, yet. Natural gas, which has the potential to help reduce total greenhouse gas emissions, also benefits from having some fueling infrastructure in place. This means it is suited for long return to base, regional haul, and long-haul disparate routes, places where BEVs currently do not make sense.

However, one important factor to keep in mind when considering natural gas is that CNG engines have a lower efficiency in miles per diesel equivalent, and there may not be incentives available to purchase them.

One interesting development in the natural gas arena is the new X15N fuel agnostic 15-liter engine from Cummins that fleets hope will address some of their concerns with the smaller natural gas engines that have been on the market.

Natural gas has been used in combustion engines for decades, but fleets are showing renewed interest because it is a lower carbon fuel than diesel and burns cleaner. In addition, the capacity to produce renewable natural gas (RNG) has grown significantly. In fact, RNG represents 69% of the natural gas used in transportation in 2022.

Natural gas as a transportation fuel is not without its challenges. Those challenges center around things like methane leakage, tank cost and complexity, and having to modify maintenance facilities to be able to safely work on natural gas vehicles.

One thing fleets that are considering adding natural gas trucks to their operations have to look at is the cost of adding those vehicles and the payback timeline. It can take five to 10 years for fleets to see payback from their investment in natural gas vehicles and the infrastructure needed to fuel them.

Given that we are in trucking’s messy middle, and the position of BEVs on the S curve of technology adoption, it is likely that in the five to 10 years it will take for fleets to see payback on their investment in natural gas trucks that there will be significant improvements in BEVs. It is typical for technologies that are at the bottom of the curve — which is where BEVs are — to have rapid improvements in a relatively short time span. We have already seen some of this with BEVs and will likely see more, especially given government mandates that are supporting BEV deployment and addressing some of the concern surrounding charging infrastructure.

Fleets that invest in natural gas vehicles today may not have the budget to pivot to take advantage of the improved BEVs that likely will feature batteries that weigh less and have extended range. Those improvements will increase the number of applications and use cases for BEVs and make them more appealing to fleets especially given the incentives and grants that are available to defray the purchase price of the trucks.

Things can be confusing in the messy middle; fleets should take the long view when it comes to considering adding alternate-fueled vehicles to their operation to make sure they choose the option that makes sense short term but also that positions them well for the long term.