Market Insights from Black Book

Wholesale Prices, Week Ending May 29th

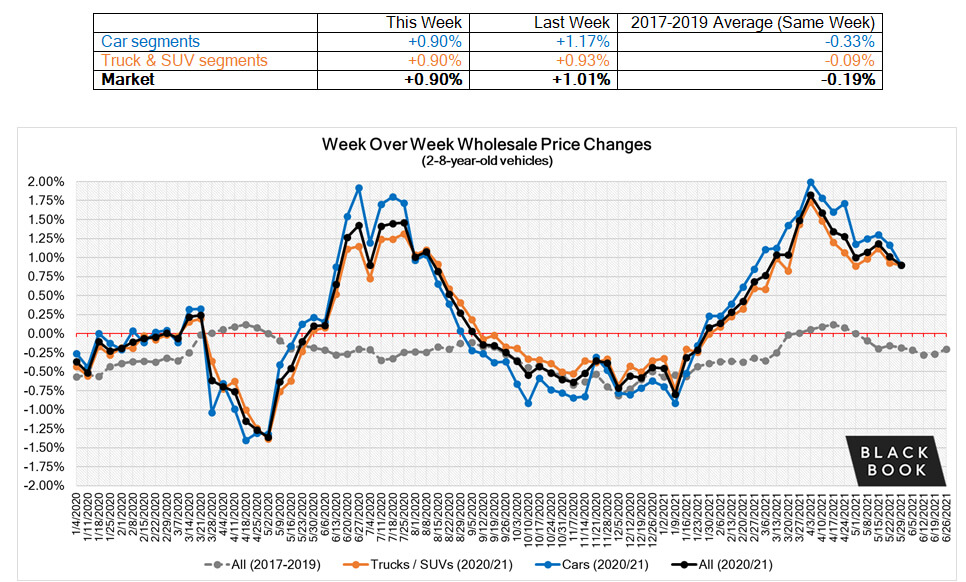

Both Car and Truck segments averaged +0.9% on a volume-weighted basis this week. That’s 18-consecutive weeks of positive gains and although the weekly rate was slightly lower than the prior, sale-conversion rates remain strong and 95.7% of price adjustments were increases.

Car Segments

- On a volume-weighted basis, the overall Car segment continued its 18-week trend, increasing this week by 0.9%. For reference, the previous weeks increase was1.17%.

- All nine car segments reported gains last week, with two exceeding +1%.

- Sub-compact and Compact segments had the largest weekly gains at 1.55% and 1.2%, respectively.

- Compact Cars have had a higher growth rate than the overall car segment average for 11-consecutive weeks.

Truck Segments

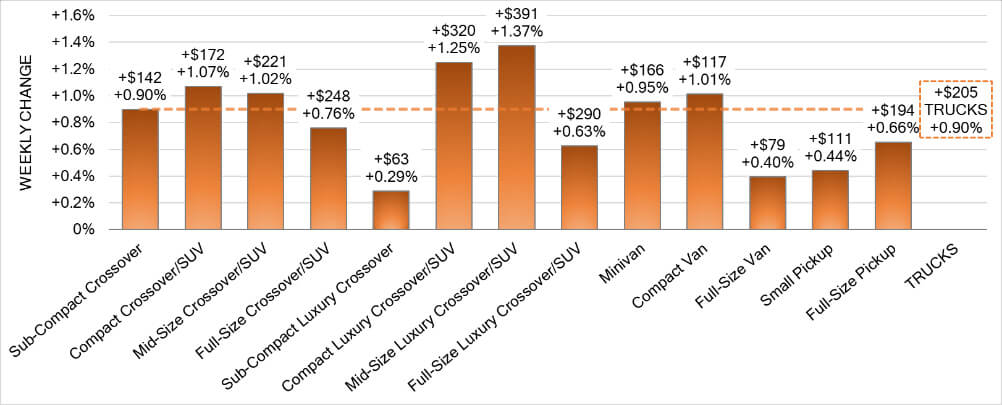

- On a volume-weighted basis, the overall Truck segment also continued its 18-week trend, increasing 0.9% this past week. For reference, the previous weeks increase was 0.93%.

- All thirteen truck segments reported gains last week, with five exceeding +1%.

- Mid-size Luxury Crossover/SUV and Compact Luxury Crossover/SUV segments had the largest weekly gains at 1.37% and 1.25%, respectively.

- Mid-size Luxury Crossover/SUV segment has had six-straight week-over-week gains, followed by Compact Luxury Crossover/SUV segments with five week-over-week gains.

Newer Used Vehicles (0-2-year-old)

Driven by an extreme shortage of rental returns and limited inventory of new vehicles, the price trends of newer used vehicles have been experiencing larger weekly gains. Within the last three weeks, newer used units reached levels that, in some cases, exceed new car pricing while the rate of growth has slowed for older units. For example, in addition to F150 Raptor, 2020-21 Chevrolet Corvette, and 2021 Jeep Gladiator and Wrangler, dealers are paying above MSRP for 2021 Kia Telluride and Hyundai Palisade, as well as other mainstream models. With wholesale prices exceeding MSRP in some cases, the rate of increase slowed down in the last several weeks.

The table below shows the average weekly price changes for 0-2-year-old vehicles.

Weekly Wholesale Index

2020 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g. 2019 calendar year) in the wholesale market were not observed for most of the year. We saw a similar picture in 2009, at the end of the Great Recession. It is now clear that 2021 will also not have typical seasonality patterns as the market is going through a rapid increase in wholesale values. The spring market arrived about 7 weeks earlier and with much stronger price increases compared to a typical pre-COVID year. The graph below looks at trends in wholesale prices of 2-6-year old vehicles, indexed to the first week of the year. Currently, wholesale prices are around 31% higher compared to the beginning of the year (adjusted for the mix).

Retail (Used and New) Insights

- Electrification is in the plans for a majority of OEMs with announcements coming out every few weeks about new models to come:

- Preorders for Kia’s first all-electric EV6 open June 3rd. The EV6 has an estimated 300-mile range and can charge in 20 minutes.

- Rivian is set to begin deliveries of its R1T electric pickup Launch Edition this summer

- The semiconductor chip shortage could cause a shortfall in US vehicle production by as many as 1.27 million vehicles in 2021, according to the Alliance for Automotive Innovation. Earlier this year, IHS Markit predicted the chip shortage would cut annual production by 1 million to 1.3 million vehicles; Alix Partners anticipated the shortage would result in between 1.5 to 5 million fewer vehicles produced.

Used Retail Prices

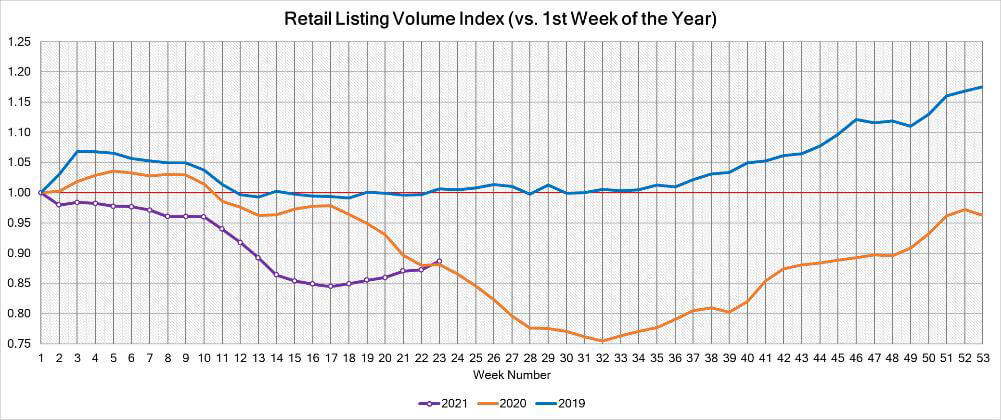

With the proliferation of ‘no-haggle pricing’ for used-vehicle retailing, asking prices accurately measure trends in the retail space. Retail demand slowed down at the end of last year, and thus resulted in declining retail asking prices over the last several weeks of 2020. As demand rebounded, retail prices have lagged slightly behind wholesale prices, but March had an accelerated growth in retail prices. In April, retail prices picked up speed as demand accelerated, fueled by stimulus payments, tax season, and shortages of new inventory. Currently, the prices are more than 18% above where we started the year.

This analysis is based on approximately two million vehicles listed for sale on US dealer lots. The graph below looks at 2-6-year-old vehicles.

Volume

Used Retail

Current used retail listing volume is about 11% below the start of the year, but the inventory levels have slowly but consistently increased over the last 6 weeks, which indicates that dealers are able to procure inventory.

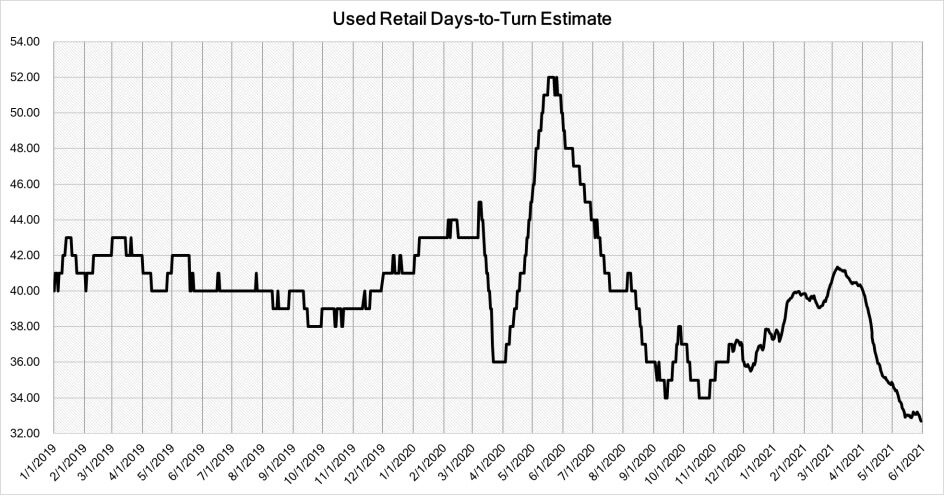

Days-to-turn has been decreasing since the middle of March, which reflected an increase in retail demand across the country, but now, days-to-turn has started to stabilize.

Wholesale

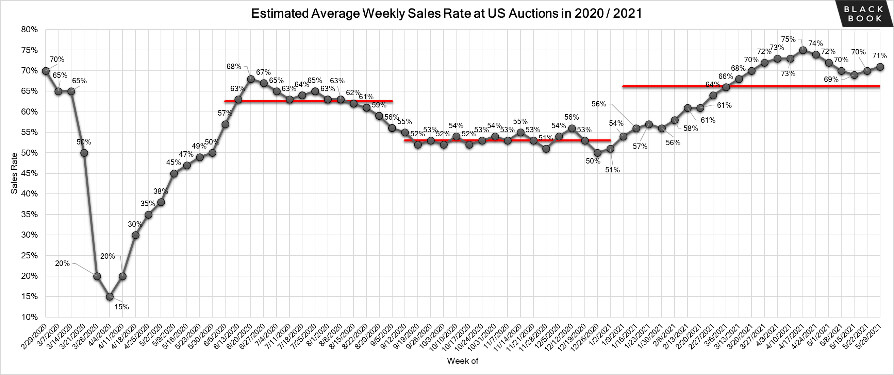

- Floor pricing continues to increase each week, but availability of average and clean units remains scarce which is leading to declining conversion rates in recent weeks.

- Despite the limited inventory on dealer lots, many dealers are finding themselves receiving greater profit margins in the wholesale channel as opposed to their own retail lots.

- Armed with the knowledge that their available inventory in the pipeline is extremely limited, remarketers are finding that they are able to continue to raise their floors and hold firm on their set values. They plan to accept a no-sale this week with the expectation it will sell the next.

Originally posted on Agent Entrepreneur