EV affordability threatened by cobalt prices: Did the US let resource control lapse over oil?

Just as the Middle East has been a strategic center in global oil politics, the Democratic Republic of Congo has become the epicenter for the raw materials needed for electric vehicles—especially cobalt.

The country is the source of more than two-thirds of global cobalt, according to the New York Times—a boom that’s feeding something not unlike a gold rush in that African nation, along with some continued concerns over the social and environmental collateral damage.

A recent visit by the NYT and its podcast The Daily provided an impression of what that economy looks like—feeding everything from large-scale mining operations to “freelance” cobalt miners literally shoveling dirt out of the ground. And yet, many of the larger operations are controlled by China.

Cobalt is an essential material for the lithium-ion batteries commonly used in modern EVs, and as the U.S. Department of Energy recently pointed out, it typically accounts for about a quarter of the total cost of batteries.

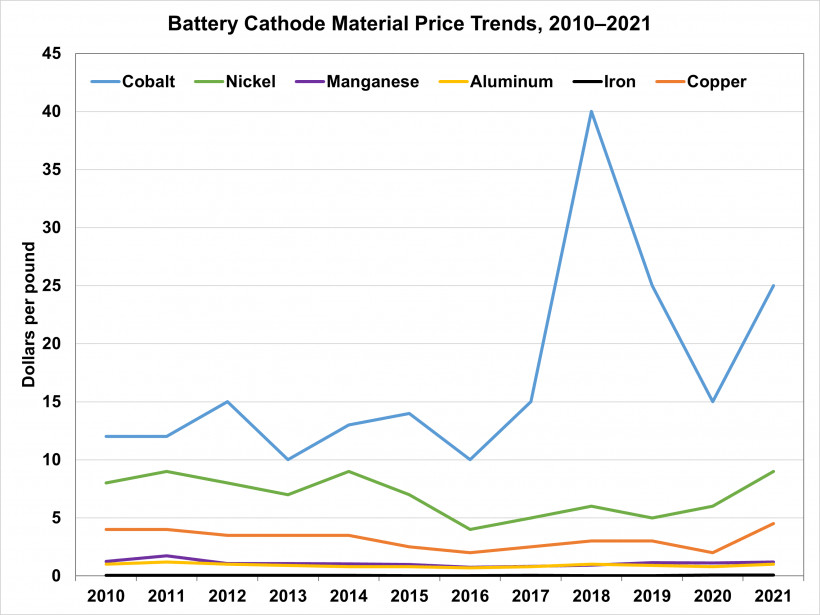

EV battery cathode material price trends, 2010-2021 – U.S. DOE

After a spike to $40 per pound in 2018, from what had been in the $10 to $15 range for years prior, cobalt prices dropped for several years and now they’re surging again nearly as high—to about $37 per pound as of last week.

It’s the primary factor for why analysts now expect that EV battery affordability gains are on hold—likely until 2024 or even later.

Meanwhile, the power struggle over cobalt in that country has “rattled the clean-energy revolution,” according to the NYT, as U.S. interests that helped develop and oversee the cobalt market for decades, partly with strategic support from the U.S. government, started selling their stakes to China just on the cusp of the electric-vehicle surge.

![Child laborers in wolframite and casserite mine, Kailo, DRC, by Julien Harneis, 2007 [CC BY-SA 2.0] Child laborers in wolframite and casserite mine, Kailo, DRC, by Julien Harneis, 2007 [CC BY-SA 2.0]](https://carsnspeed.net/wp-content/uploads/2022/03/ev-affordability-threatened-by-cobalt-prices-did-the-us-let-resource-control-lapse-over-oil-1.jpg)

Child laborers in wolframite and casserite mine, Kailo, DRC, by Julien Harneis, 2007 [CC BY-SA 2.0]

The U.S. government let that happen in what has been described by reporters tracking the trend as a distraction over the obsession on oil resources.

This sale of cobalt control to China was happening as recently as during the Trump administration—just before widespread political awareness of the situation started with a USGS and Department of Commerce review conducted under that administration. The Biden administration has moved to ramp up raw materials for an American-made EV supply chain.

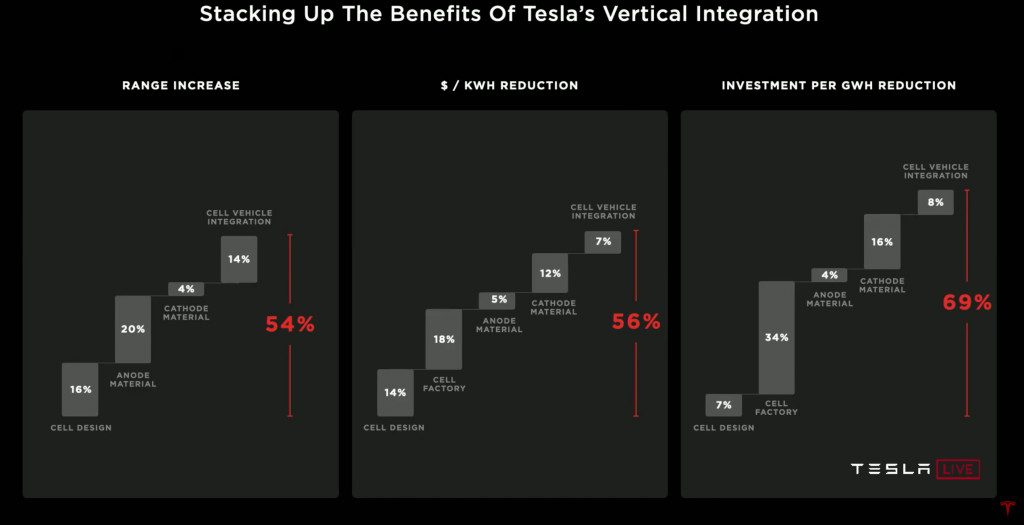

Most of a decade ago, when Tesla planned its Nevada Gigafactory, it found it couldn’t source enough lithium, cobalt, graphite, and other key materials from U.S. suppliers.

Tesla Battery Day vertical integration overview

That’s part of the reason why Tesla—and soon, Rivian—have turned to lithium-iron phosphate (LFP) battery cells that don’t rely on cobalt or nickel but sacrifice driving range. Ironically, given China’s control on the cobalt market, this is the cell chemistry that Chinese automakers have opted to popularize and mass-produce in their home market, while the West has become increasingly dependent on resources under the control of Chinese resource suppliers.

Nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) are the two most common chemistries for lithium-ion EV battery cells. Tesla has also been looking at ways to up the content of more plentiful manganese in its cells—potentially stretching its strained supply of cobalt farther. And sodium-ion cells—likely farther off—offer the potential to avoid lithium, which is another resource the U.S. did maintain production of—in the past.

Did we throw cobalt away in the war for oil? Listen to that podcast, and leave your comments below.