Engine Parts Suppliers Facing Uncertain Future With Switchover To EVs

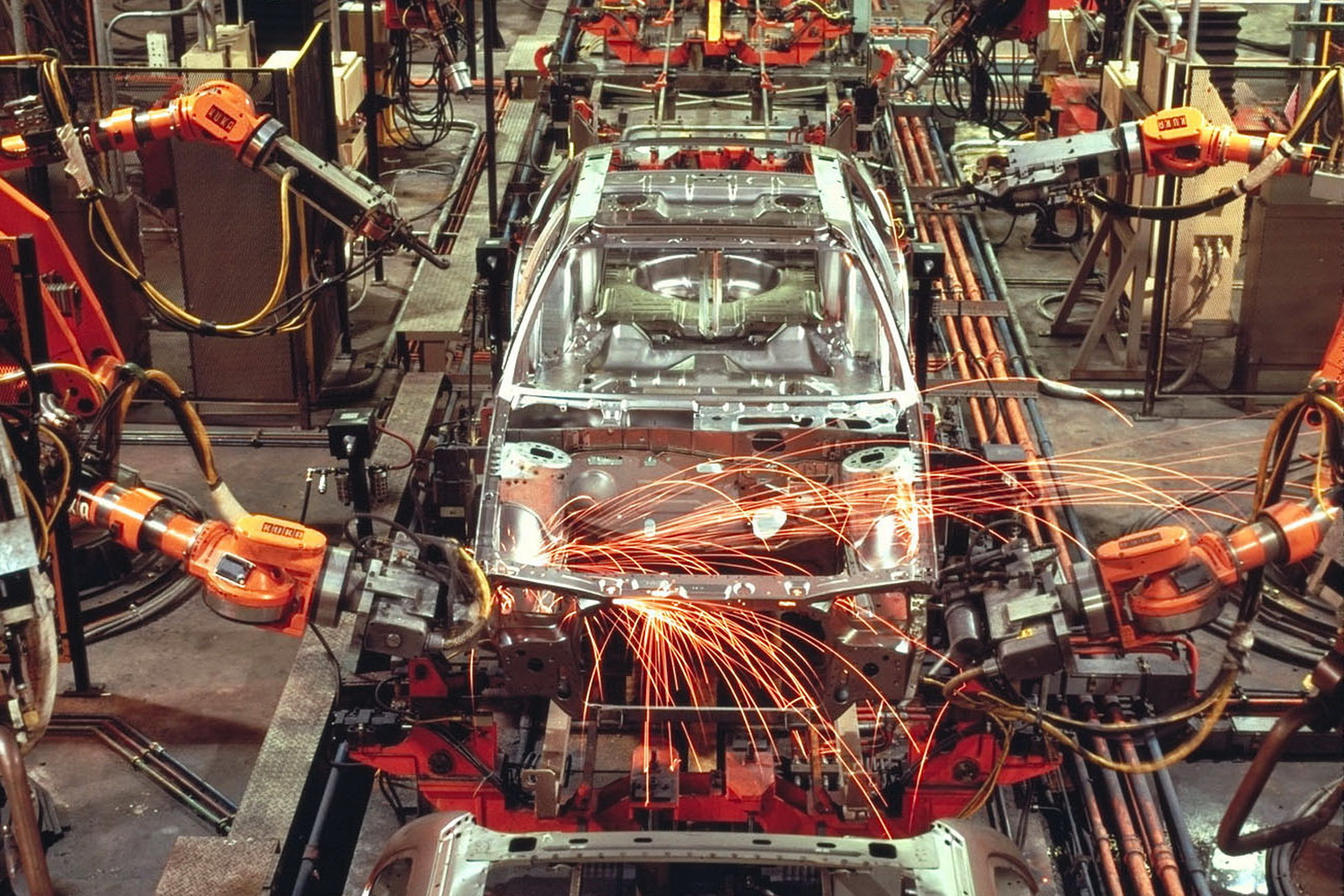

European auto parts suppliers, particularly those manufacturing parts for internal combustion engines, are facing an existential crisis as the continent gears up to switch over to EVs. Since battery-powered cars are yet to meet their full sales potential, suppliers are in a situation where they need to invest heavily in new equipment to cater to EV manufacturing while at the same time seeing their current income decline due to slowing conventional vehicle sales.

In the case of Evtec Aluminum, a supplier of engine components to Jaguar Land Rover with two plants in the UK, an investment of millions of pounds in machinery to manufacture parts for diesel engines (because diesel was the dominant fuel in Europe over the past decade) only brought idled machines and massive losses because the EU turned away from the fuel following Volkswagen’s “Dieselgate” scandal.

Now the focus has turned to EVs, and many EU countries are considering completely banning combustion engines by 2035. Evtec managed to survive because it was taken over by an investor group led by David Roberts, who felt it was a “no brainer to invest in that business” because the company’s ability to manufacture complex aluminum components will almost certainly attract business from manufacturers looking for EV parts.

Read: Partsmaker Bosch Expresses Concern Over Rapid EV Shift

Other companies, such as German powertrain supplier Vitesco Technologies Group AG, are looking to shift their focus from combustion engines towards EVs, expecting them to account for 70 percent of the vehicle market by 2030, reports Reuters. To that end, their business will be split into two main divisions; one for EV components and the other for higher-value technology that can be utilized in combustion engines and can generate higher revenue in a declining segment.

Because EV motors have around a third of the parts of combustion engines, manufacturers have warned of massive job losses in component manufacture. For example, Stellantis is in the process of switching over its engine plant in Tremery, France, to EV motor manufacture, and has already cut the workforce from 3,000 to 2,400 and is expecting further downsizing.

According to auto industry consultant Bernd Bohr, the larger and deeper-pocketed suppliers will likely be the last ones standing. Smaller companies, on the other hand, will have to adapt, consider diversifying, or face the very real possibility of going out of business.