Black Book: Weekly Market Updates

Wholesale Prices, Week Ending June 19th

Wholesale prices remain strong, however there are signs of softening in the market this week, as prices of newer used vehicles seem to be hitting a ceiling. Cars segments at +0.75% is the lowest weekly gain in seventeen weeks and Truck / SUV segments at +0.68% is the lowest weekly gain in fifteen weeks.

This Week Last Week 2017-2019 Average (Same Week)

Car segments +0.75% +0.97% -0.35%

Truck & SUV segments +0.68% +0.94% -0.22%

Market +0.70% +0.95% -0.27%

Car Segments

- On a volume-weighted basis, the overall Car segment continued its 21-week trend, increasing this week by 0.75%.

- For reference, the previous weeks increase was 0.97%.

- Compact car segment, the only segment to increase over 1% this week, had the largest weekly gain at 1.29%.

- The Compact car segment has had greater gains than the overall car segment average for 14-consecutive weeks.

- Sub-compact car segment had the lowest change-rate at +0.12%.

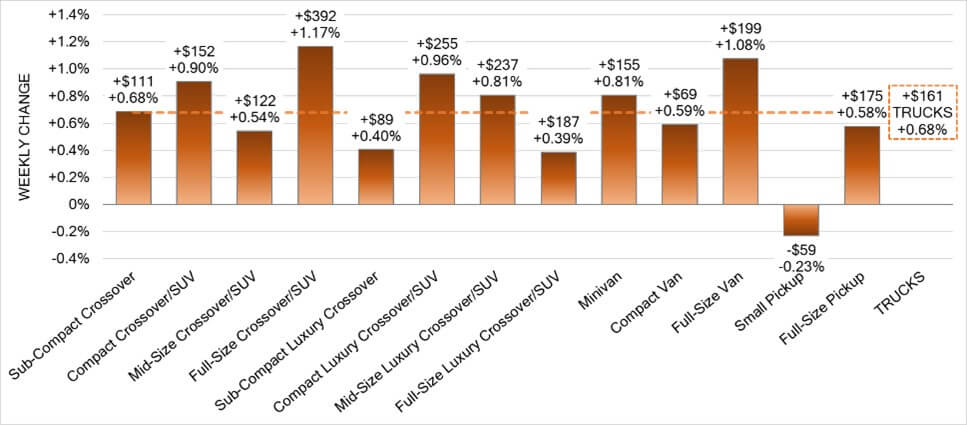

Truck / SUV Segments

- On a volume-weighted basis, the overall Truck segment increased 0.68% this past week.

- For reference, the previous weeks increase was 0.94%.

- Only two of the thirteen segments gained more than 1%.

- Full-size Crossover/SUV segment had the highest gains for the week at 1.17%, followed closely by Full-size Vans at +1.08%.

- The Small Pickup segment weekly rate has decreased for seven consecutive weeks, resulting in its first decline in 21-weeks.

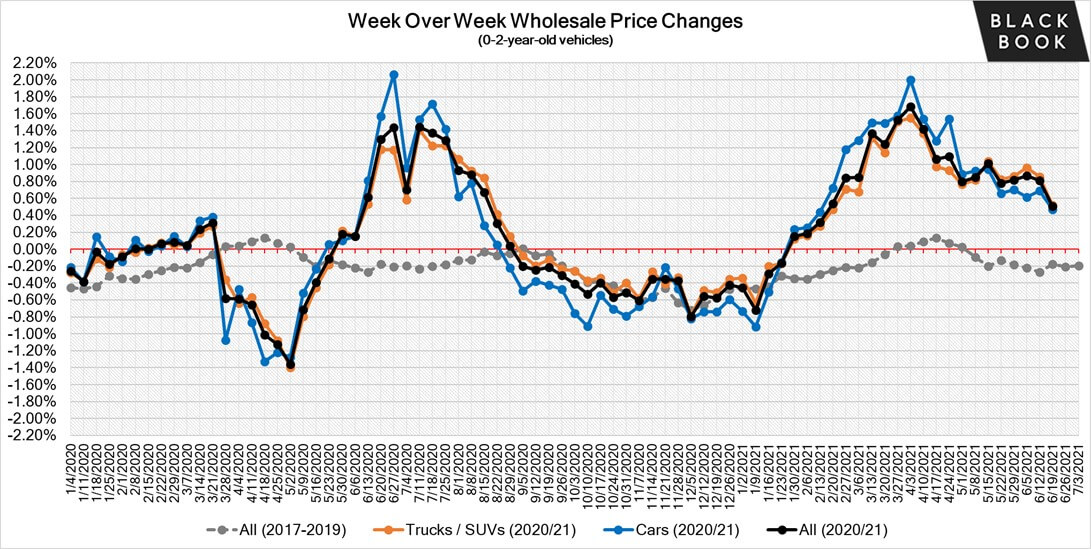

Newer Used Vehicles (0-2-year-old)

Driven by an extreme shortage of rental returns and limited inventory of new vehicles, the prices of newer used vehicles have been experiencing large weekly gains. While wholesale prices are exceeding MSRP in some cases, the rate of increase has started to slow down in the last several weeks. The table below shows the average weekly price changes for 0-2-year-old vehicles.

This Week Last Week 2017-2019 Average (Same Week)

Car segments +0.47% +0.69% -0.23%

Truck & SUV segments +0.52% +0.86% -0.15%

Market +0.51% +0.81% -0.18%

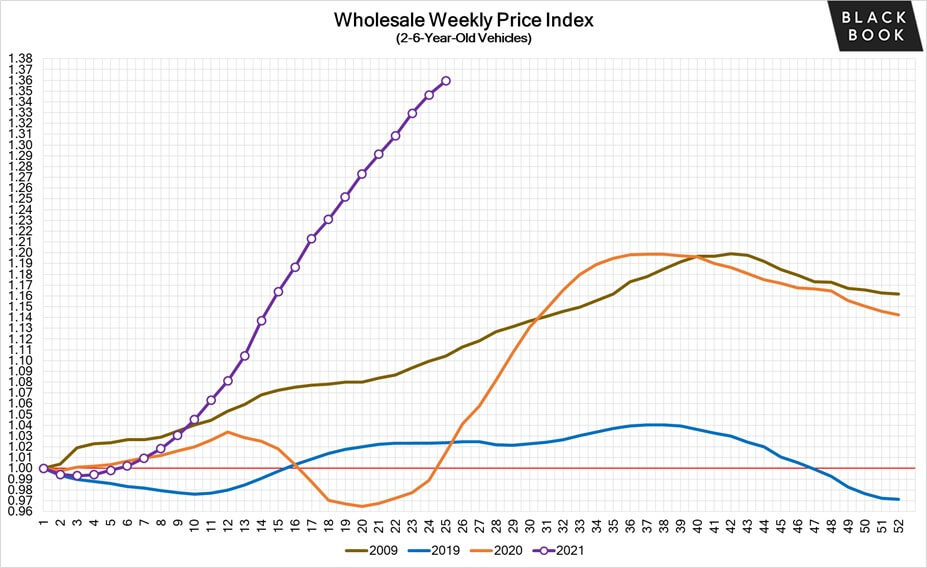

Weekly Wholesale Index

2020 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g. 2019 calendar year) in the wholesale market were not observed for most of the year. We saw a similar picture in 2009, at the end of the Great Recession. It is now clear that 2021 will also not have typical seasonality patterns as the market is going through a rapid increase in wholesale values. The spring market arrived about 7 weeks earlier and with much stronger price increases compared to a typical pre-COVID year. The graph below looks at trends in wholesale prices of 2-6-year old vehicles, indexed to the first week of the year. As we move into summer, wholesale prices are around 36% higher compared to the beginning of the year (adjusted for the mix).

New Retail (Used and) Insights

- The next-generation Maserati GranTurismo sports coupe will be all-electric, giving the automaker its first EV.

- Polestar announced they would be building their next EV, the Polestar 3, in South Carolina starting next year.

- Lincoln announced that they would be going full EV by 2030, starting with an Aviator-sized SUV that is scheduled to debut in 2022.

- Canoo announced they plan to manufacture their fully electric Lifestyle Vehicle in Oklahoma starting in 2022.

Used Retail Prices

With the proliferation of ‘no-haggle pricing’ for used-vehicle retailing, asking prices accurately measure trends in the retail space. Retail demand slowed down at the end of last year, and thus resulted in declining retail asking prices over the last several weeks of 2020. As demand rebounded, retail prices have lagged slightly behind wholesale prices, but March had an accelerated growth in retail prices. In April and May, retail prices picked up speed as demand accelerated, fueled by stimulus payments, tax season, and shortages of new inventory. Currently, the prices are more than 22% above where we started the year.

This analysis is based on approximately two million vehicles listed for sale on US dealer lots. The graph below looks at 2-6-year-old vehicles.

Inventory

Used Retail

Current used retail listing volume is about 11% below the start of the year. The inventory levels have been slowly but consistently increasing over the last 7 weeks, as we see some softening of retail demand.

Days-to-turn has continued to decrease since the middle of March as sourcing both new and used inventory continues to be a challenge; it now stands just below 32 days, which as the graph below shows, is lower than we have seen in the recent past.

Wholesale

As floor pricing remains strong and the availability of average and clean vehicles remains scarce, conversion rates have started to slow down.

- Despite the limited inventory on dealer lots, dealer lanes continue to have higher volume at auction.

- While manufacturers’ remarketing lanes are offering less and less in open sales channels.

- Many dealers are finding higher profit margins in the wholesale channel as opposed to their own retail lots.

- OEM remarketers are able to continue naming their price in the lanes for vehicles as a result of an extremely limited inventory pipeline.

Originally posted on F&I and Showroom