Black Book: Weekly Market Update

Wholesale Prices, Week Ending January 21st

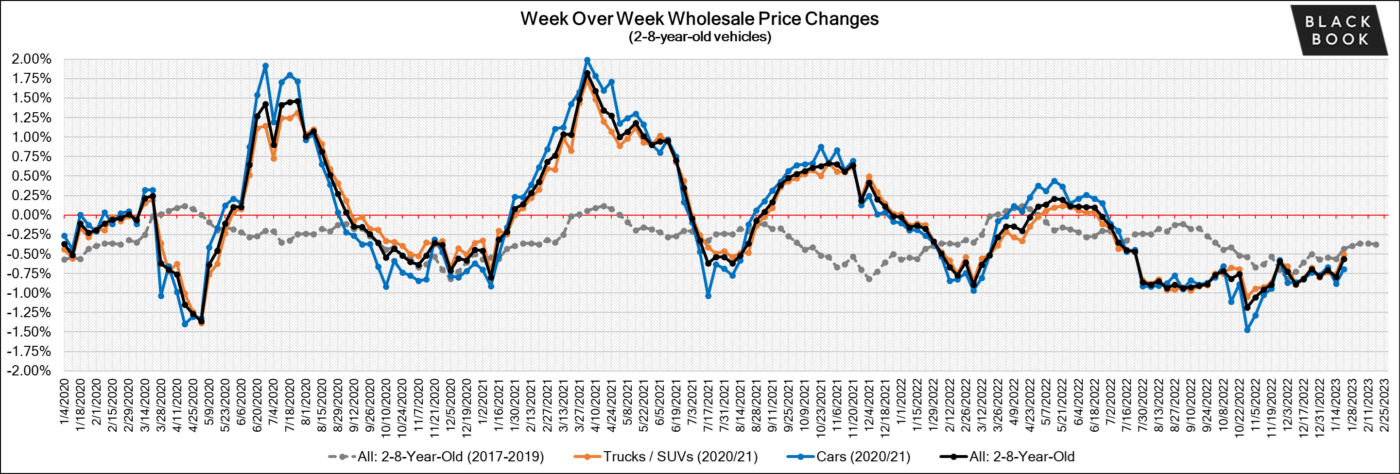

Last week, the price declines lessened, coming in at a level on par with last July (apart from the weeks around Thanksgiving and Christmas when volume and conversions were down), before the declines began to accelerate for Q3 and Q4.

This Week Last Week 2017-2019 Average (Same Week)

Car segments -0.69% -0.88% -0.49%

Truck & SUV segments -0.50% -0.75% -0.39%

Market -0.56% -0.79% -0.43%

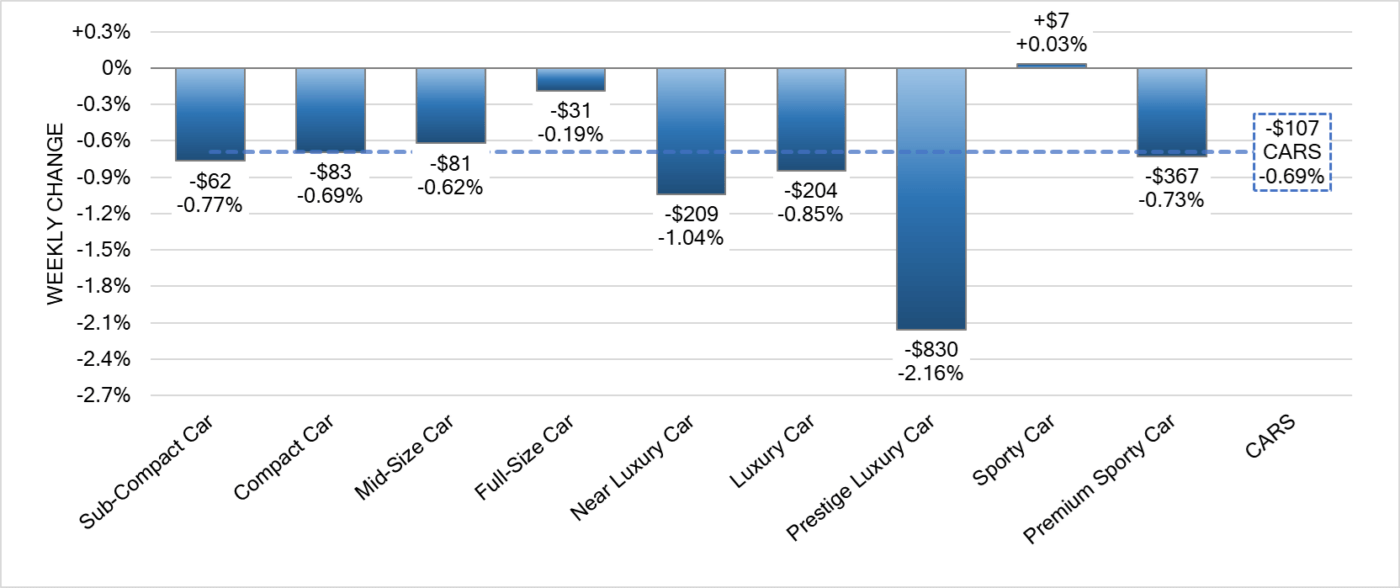

Car Segments

- On a volume-weighted basis, the overall Car segment decreased -0.69%. For reference, the previous week, cars decreased by -0.88%.

- Eight of the nine Car segments decreased last week, with two reporting declines greater than 1% (Prestige Luxury, -2.16%; Near Luxury, -1.04%).

- Prestige Luxury Car and Near Luxury Car average segment declines were pulled down due to large declines of the Tesla Model S and Model 3 wholesale values as a result of the new vehicle pricing cuts that Tesla took the week prior.

- For the first time since June, Sporty Cars moved back into positive territory with an increase of +0.03%.

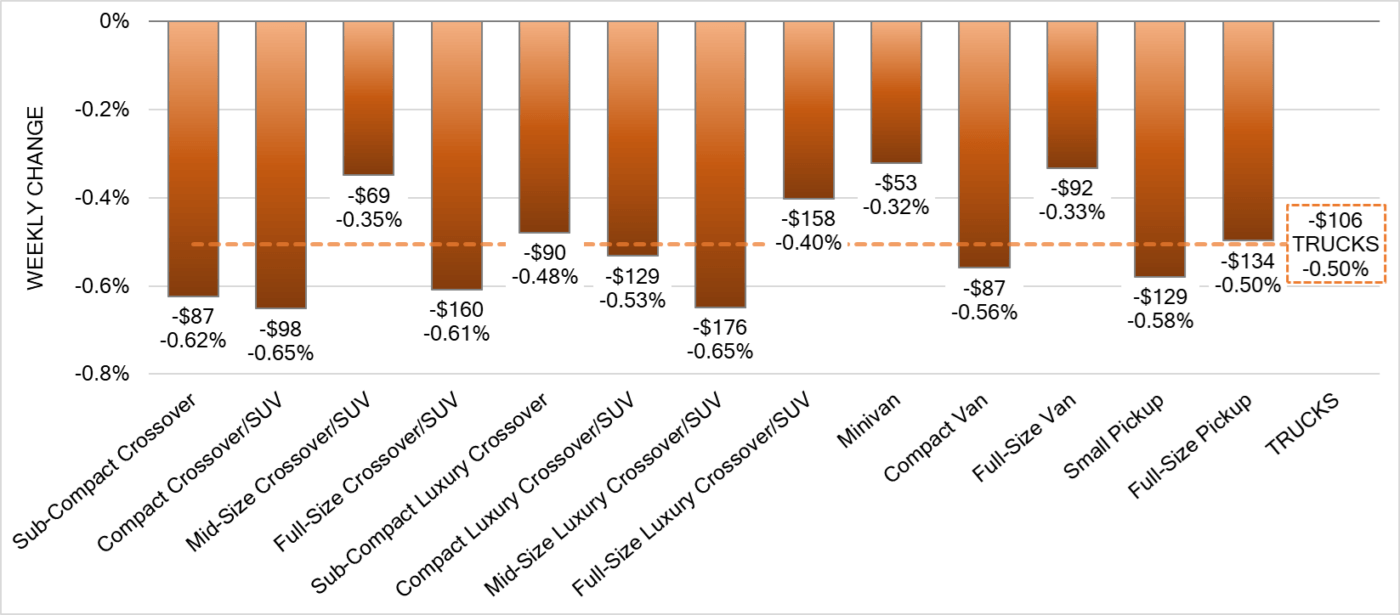

Truck / SUV Segments

- The volume-weighted, overall Truck segment decreased -0.50%, compared with the prior week’s decline of -0.75%.

- All thirteen Truck segments reported declines last week, but for the first time in seven weeks, none of the declines exceeded 1%.

- Tesla Model Y and Model X also experienced large declines last week, but the large Truck segment sizes prevented the overall segment averages from being impacted. Despite the large drops for Tesla, the Compact Luxury (-0.53%) and Mid-Size Luxury (-0.65%) Crossover/SUV segments reported smaller declines compared to the week prior.

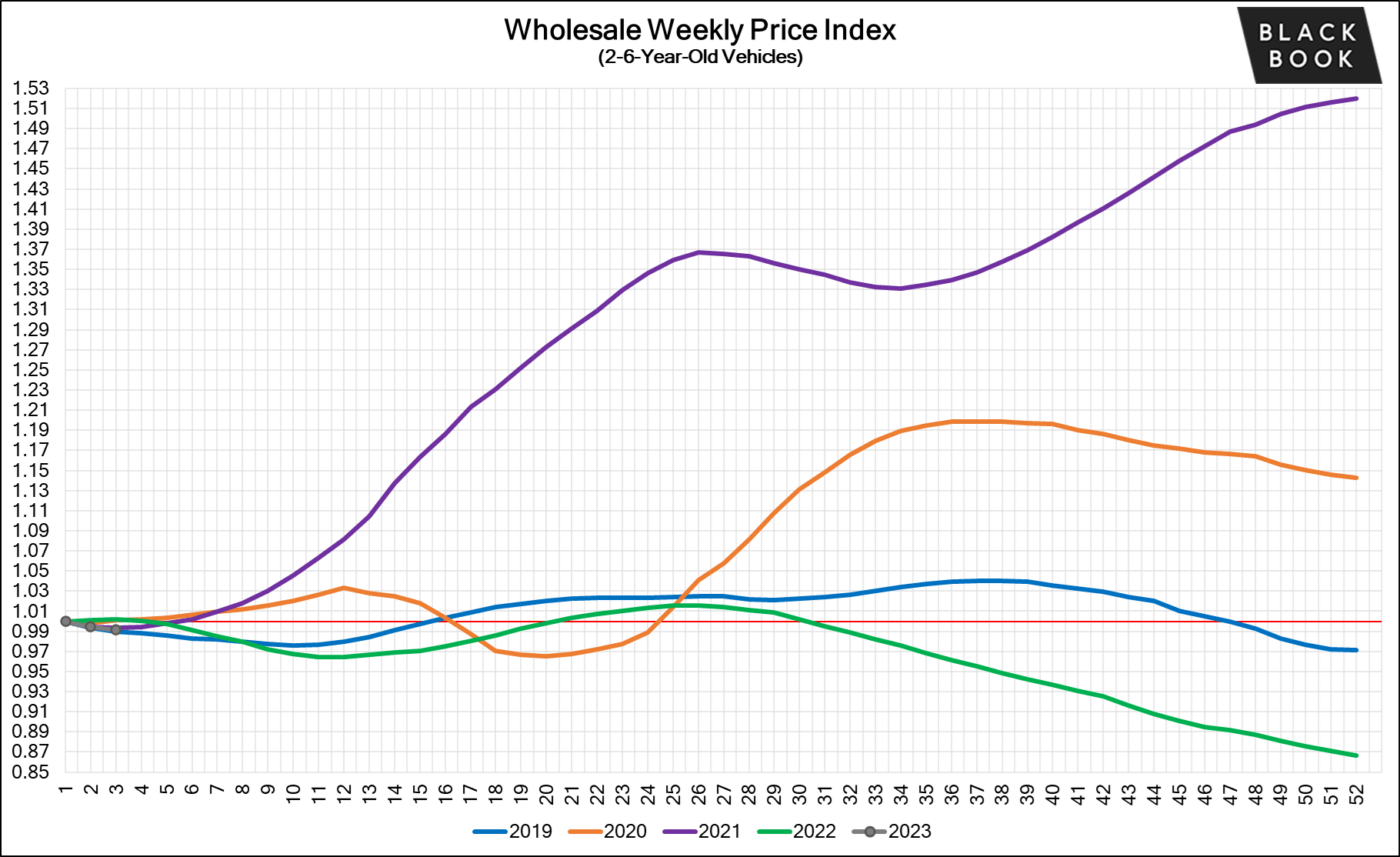

Weekly Wholesale Index

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements.

Calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last three years. We saw a similar picture in 2009, at the end of the Great Recession. Calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for most of the year. The Wholesale Weekly Price Index reached the highest point of the year at the end of December 2021, reporting over 1.51 points. In 2022, the price index was on a mild rollercoaster until July, after which point prices were on a continuous decline until the end of the year.

Retail (Used and New) Insights

- Mercedes-Benz revealed the refreshed 2024 CLA that is expected to be available later this year. The updated CLA included a 48-volt hybrid system that gives the car an additional boost to go along with the updated styling.

- Chevrolet is releasing additional details about the much-anticipated all-electric Corvette that is slated to arrive later this year as a 2024 model year. The all-wheel drive Corvette E-Ray will start at $104,295 for the coupe version and $111,295 for a hardtop convertible and is stated to be faster than the more expensive gas-guzzling Z06.

- General Motors has preliminary designs of an all-electric two-door pickup truck that would compete with the Ford Maverick and start under $30,000.

- The Ford Bronco remains a hot commodity for consumers, but Ford continues to struggle to build enough to meet demand. Their solution to not losing customers is a new program offering $2500 to customers that switch their order to another Ford model by early April.

Used Retail Prices

Used Retail Prices are more accessible than in years past, due to the proliferation of ‘no-haggle pricing’ for used-vehicle retailing. Transparent pricing upfront makes the car buying process more enjoyable for customers and allows Black Book to accurately measure retail market trends.

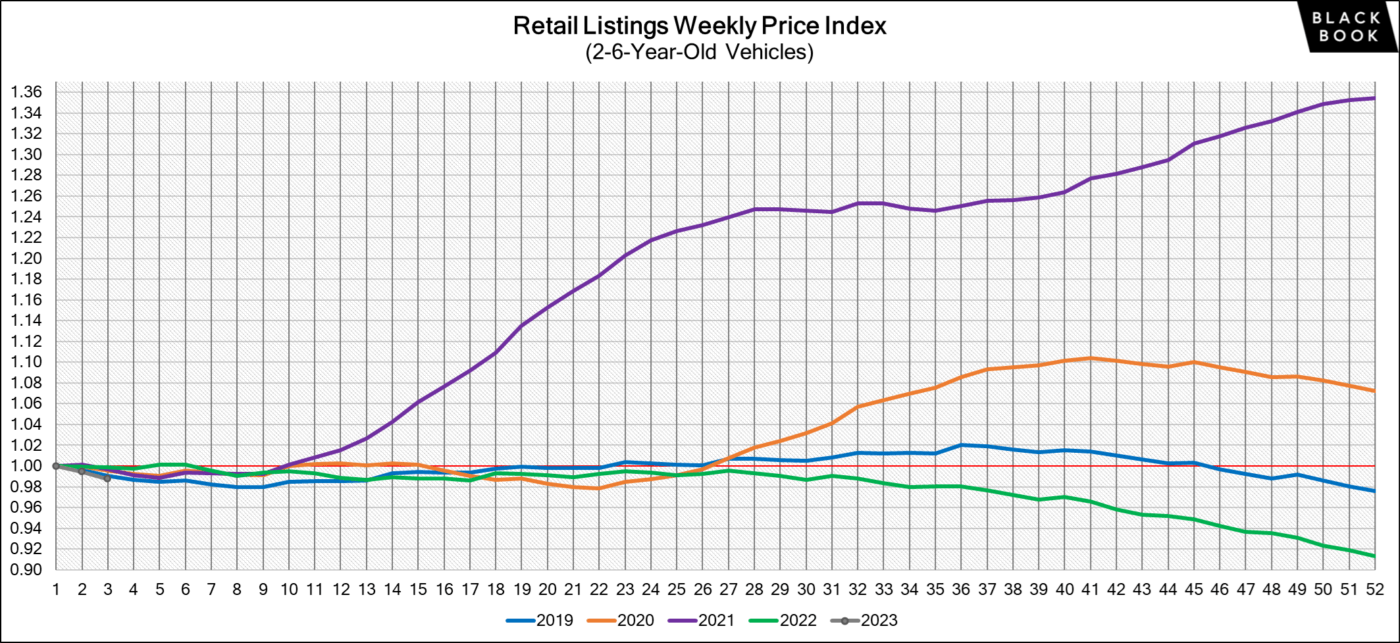

At the on-set of the pandemic, in CY2020, used retail prices increased slightly, following typical seasonal patterns, and then began dropping in April, finally hitting a low point in the late spring months. By late summer of CY2020, Used Retail Prices increased as supply of new vehicle inventory started to become scarce, but retail demand slowed down at the end of CY2020, resulting in declining retail asking prices for the last several weeks of the year. When CY2021 kicked off, demand rebounded while retail prices lagged slightly behind wholesale prices; March of 2021 started the dramatic increases in Used Retail Prices, fueled by stimulus payments, tax season, and shortages of new inventory. During the third quarter, retail prices continued to rise at a slower rate but soon picked up the pace once again to start the fourth quarter. In Q4, prices on retail listings steadily increased week after week. As CY2021 came to an end, the retail listing price index closed 36% above where the year began. The index has remained relatively stagnant through most of CY2022. In the fourth quarter of 2022, the Retail Listings Price Index declines started, but not as steep as the wholesale price index.

This analysis is based on approximately two million vehicles listed for sale on U.S. dealer lots. The graph below looks at 2-6-year-old vehicles. The Index is computed keeping the average age of the mix constant to identify market movements.

Inventory

Used Retail

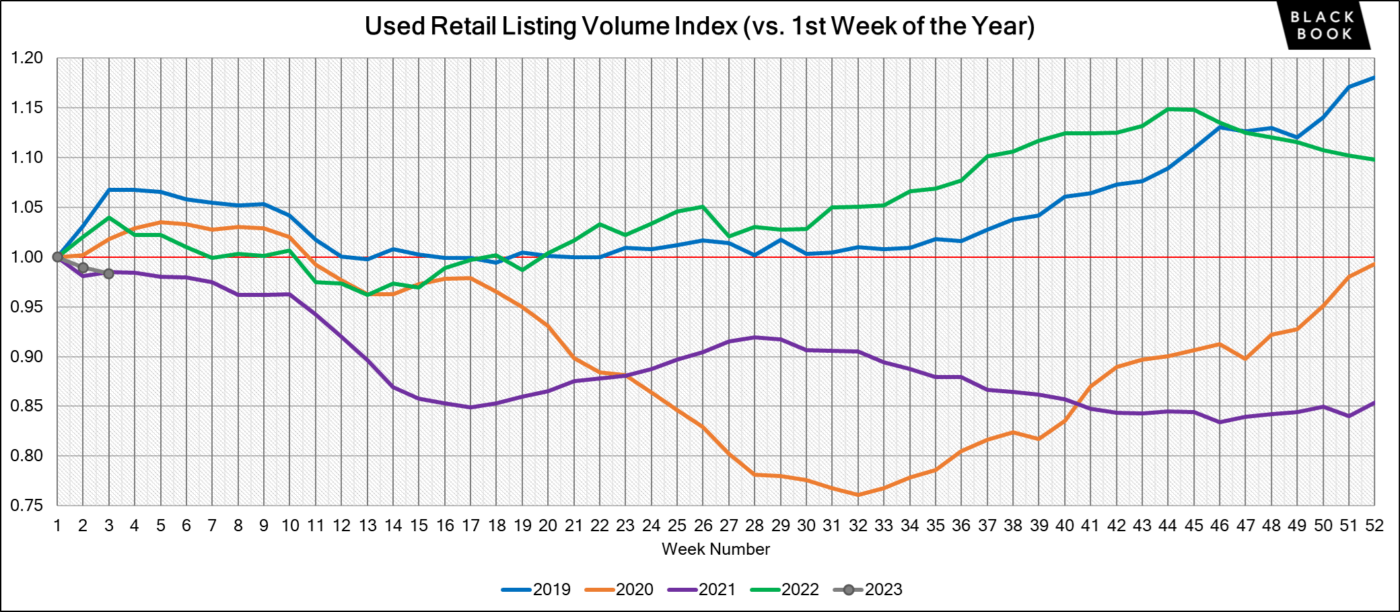

Used retail active listing volume index reverted back to one at the start of 2023. Currently, the index sits at 0.99 points – a slight decline from the previous week.

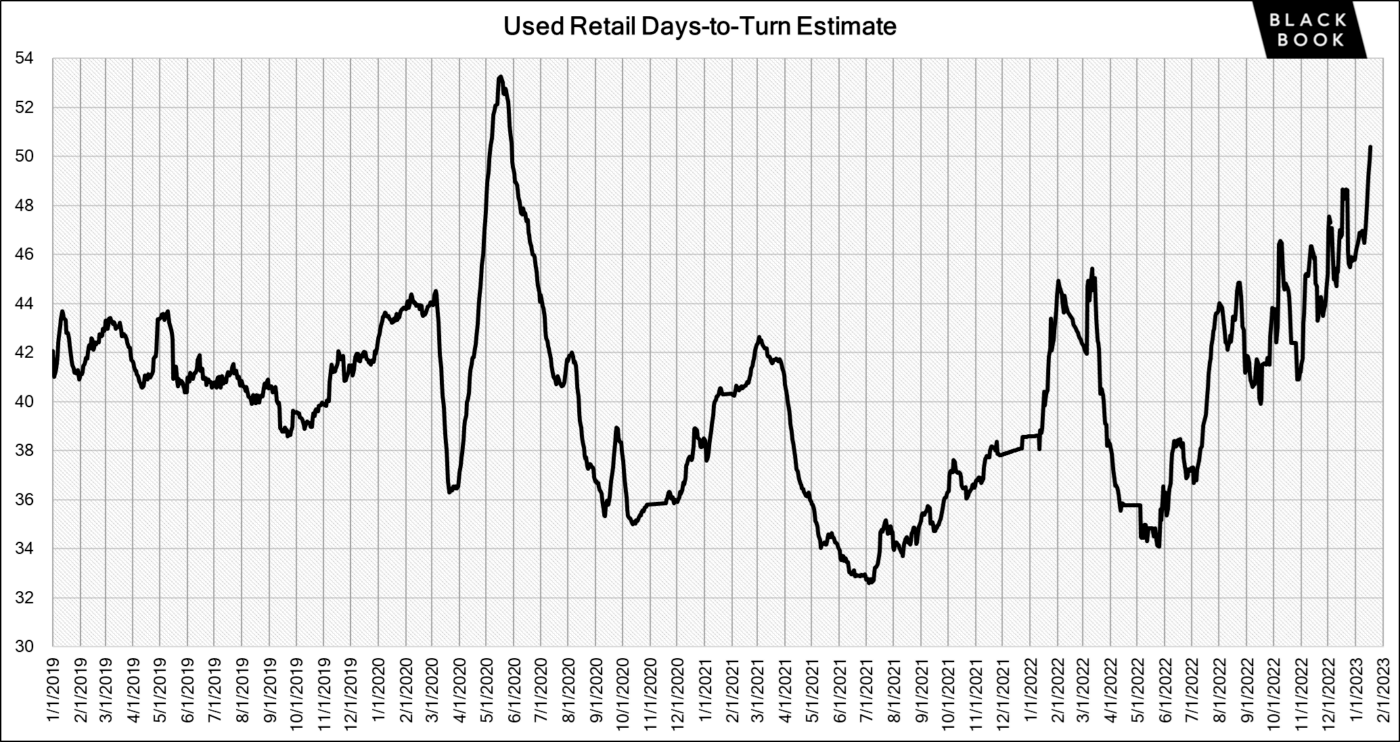

The Used Retail Days-to-Turn estimate is around 50 days.

Wholesale

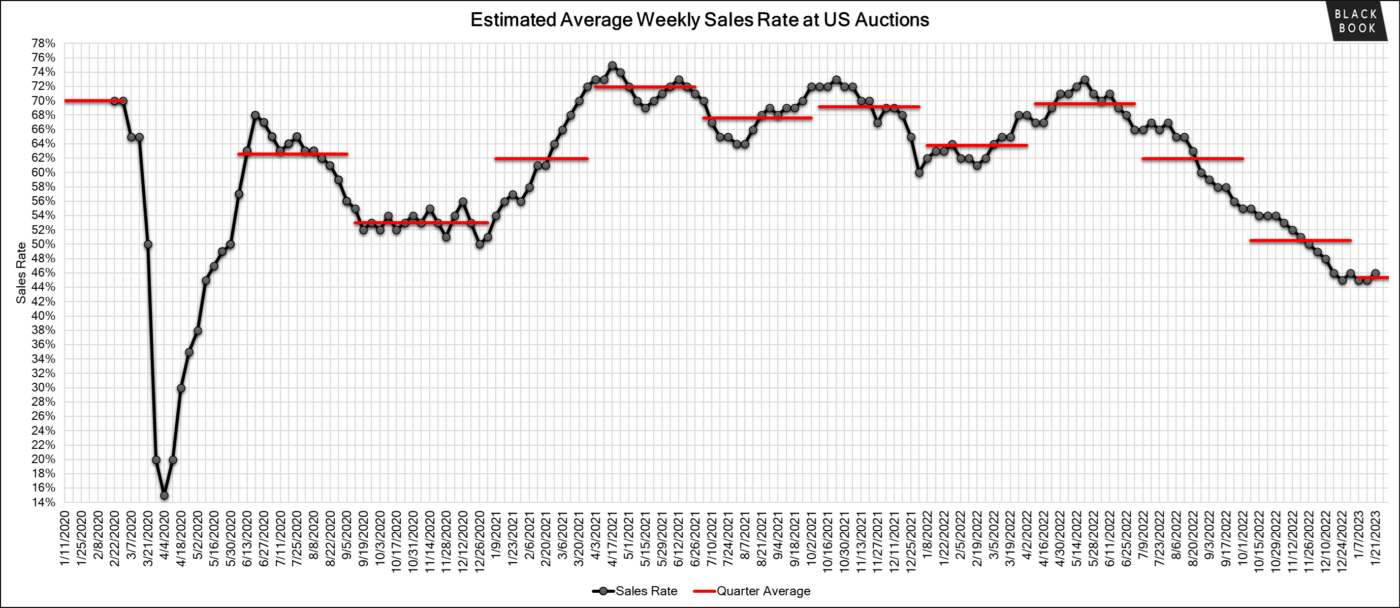

Sales rates improved last week as bidder engagement on the lanes stepped up. Selections across the auctions improved last week with more newer model years, particularly model year 2023s starting to show up. We continue to watch for the tell-tell signs of a spring market and last week we got our first sign – an increase in the Sporty Car segment. In addition to watching for the signs of spring, our auctions spotters paid close attention to the activity in the lanes on Tesla’s after the shocking news of large price drops across the line-up, and many of the Tesla’s that ran the lanes ended on an IF bid. Retail listing prices of all Tesla models fell each day last week and subsequently, we saw large drops on the models that were sold through the wholesale channel.

The Estimated Average Weekly Sales Rate improved to 46% last week.