Black Book: Weekly Market Report

Black Book Market Insights – 1/17/2023

Wholesale Prices, Week Ending January 14th

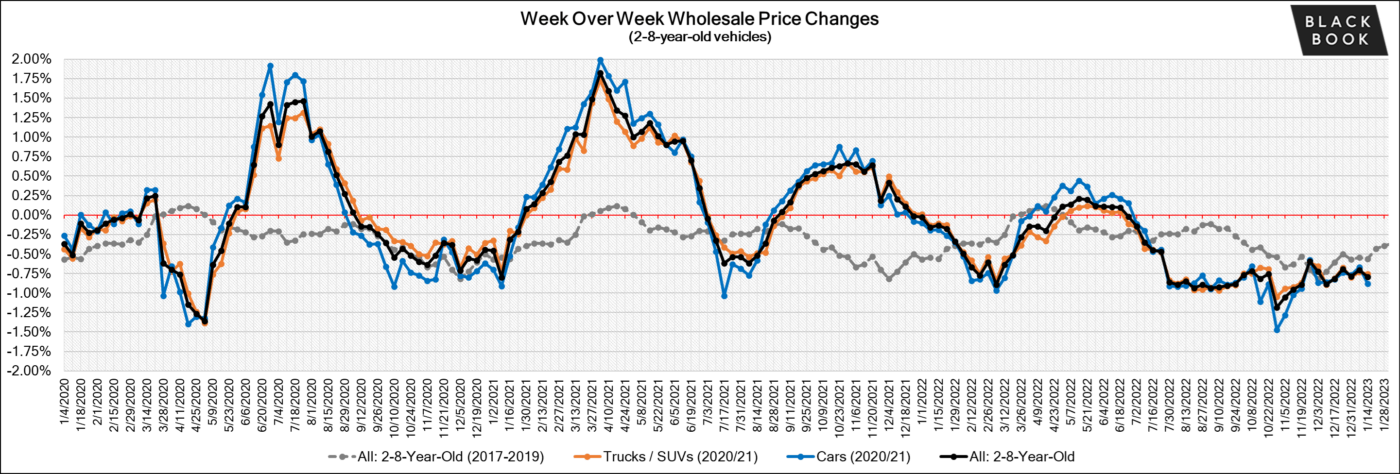

With two weeks of the new year now behind us, the trends that we ended 2022 with are continuing into 2023. Sales rates at the auctions continue to be less than ideal and weekly depreciation continues at a rate that exceeds what is typically experienced this time of year. In other industry news, Tesla’s announcement of price cuts is already impacting used valuations over the weekend.

This Week Last Week 2017-2019 Average (Same Week)

Car segments -0.88% -0.67% -0.62%

Truck & SUV segments -0.75% -0.73% -0.52%

Market -0.79% -0.71% -0.56%

![]() Car Segments

Car Segments

- On a volume-weighted basis, the overall Car segment decreased -0.88%. For reference, the previous week, cars decreased by -0.67%.

- All nine Car segments decreased last week, with three of the nine reporting declines greater than 1% (Prestige Luxury, -1.76%; Near Luxury, -1.28%; Compact, -1.18%).

- Compact Cars reported the largest decline for the segment since the first week of November last year, when the segment declined -1.45%.

- Sporty Car depreciation has been slowing in the new year, only declining -0.19% last week, compared with an average weekly decline of -0.60% during December.

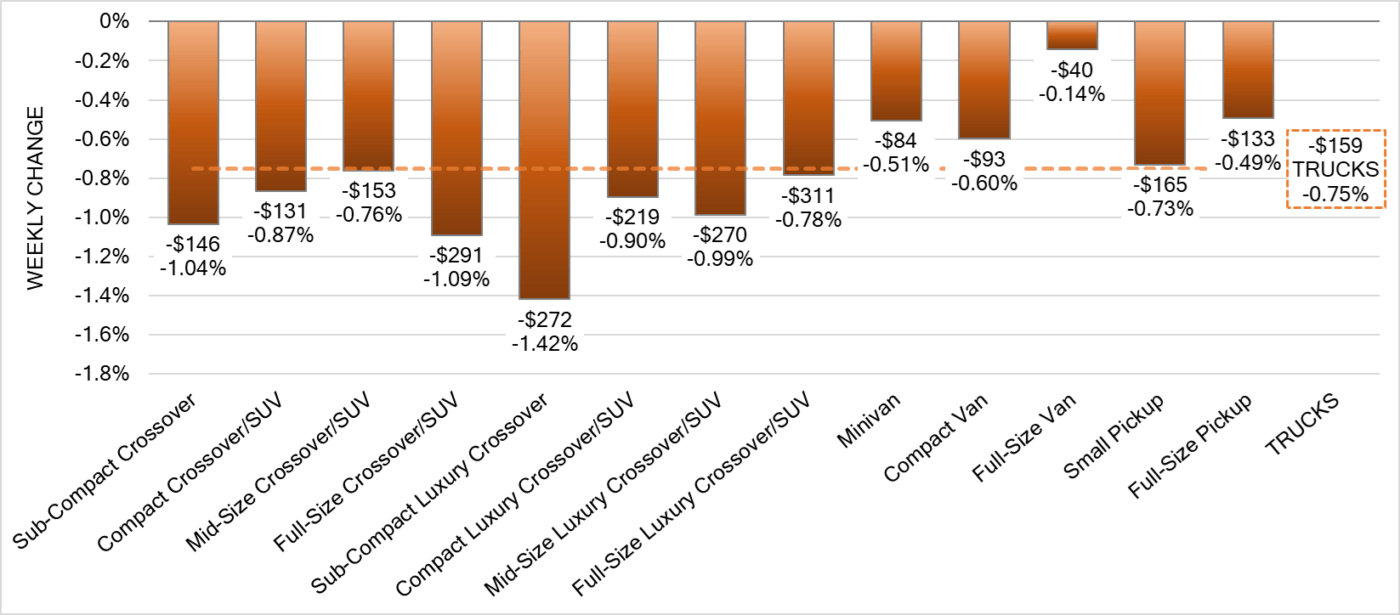

Truck / SUV Segments

- The volume-weighted, overall Truck segment decreased -0.75%, compared with the prior week’s decline of -0.73%.

- All thirteen Truck segments reported declines last week, with three of those reporting a decline of over 1% (Sub-Compact Luxury, -1.42%; Full-Size, -1.09; Sub-Compact, -1.04%).

- Full-Size Truck (-0.49%) depreciation has slowed, consistently declining less than half of a percent over the past three weeks.

- Sub-Compact Luxury Crossover/SUV has reported the largest Truck segment declines over the last two weeks, -1.42% last week, compared with -1.12% the week prior.

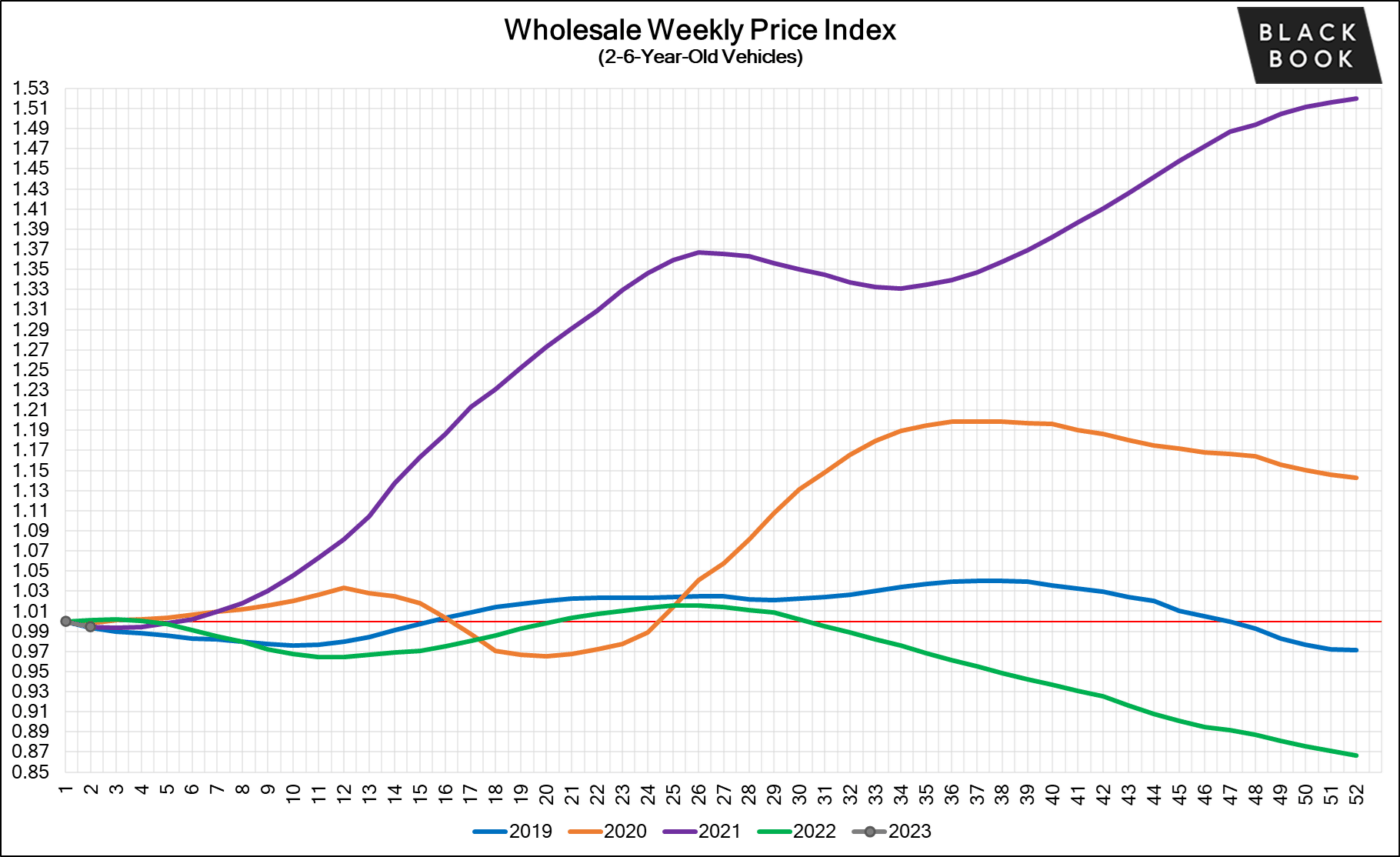

Weekly Wholesale Index

Calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last three years. We saw a similar picture in 2009, at the end of the Great Recession. Calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for most of the year. The Wholesale Weekly Price Index reached the highest point of the year at the end of December 2021, reporting over 1.51 points. In 2022, the price index was on a mild rollercoaster until July, after which point prices were on a continuous decline until the end of the year.

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements. In the second week of 2023, the index fell to 0.994 points.

Retail (Used and New) Insights

- Model year 2024 will be the final model year for the sporty coupe and convertible Jaguar F-Type. The final year will have a special send-off with a special edition variant called “75 Edition”.

- The Nissan GT-R has remained unchanged since it’s last refresh in 2017, but 2024 will bring a full-redesign to Nissan’s top of the line sports car.

- According to a German newspaper, Mercedes-Benz will be dropping EQ prefix from their naming convention as a way of denoting an all-electric model by as early as the end of next year.

- Tesla offered end of year incentives for consumers taking delivery before the end of 2022, but the price reductions didn’t stop there. Last week, Tesla made some large price adjustments to their models, for example the Model Y is now 20% cheaper.

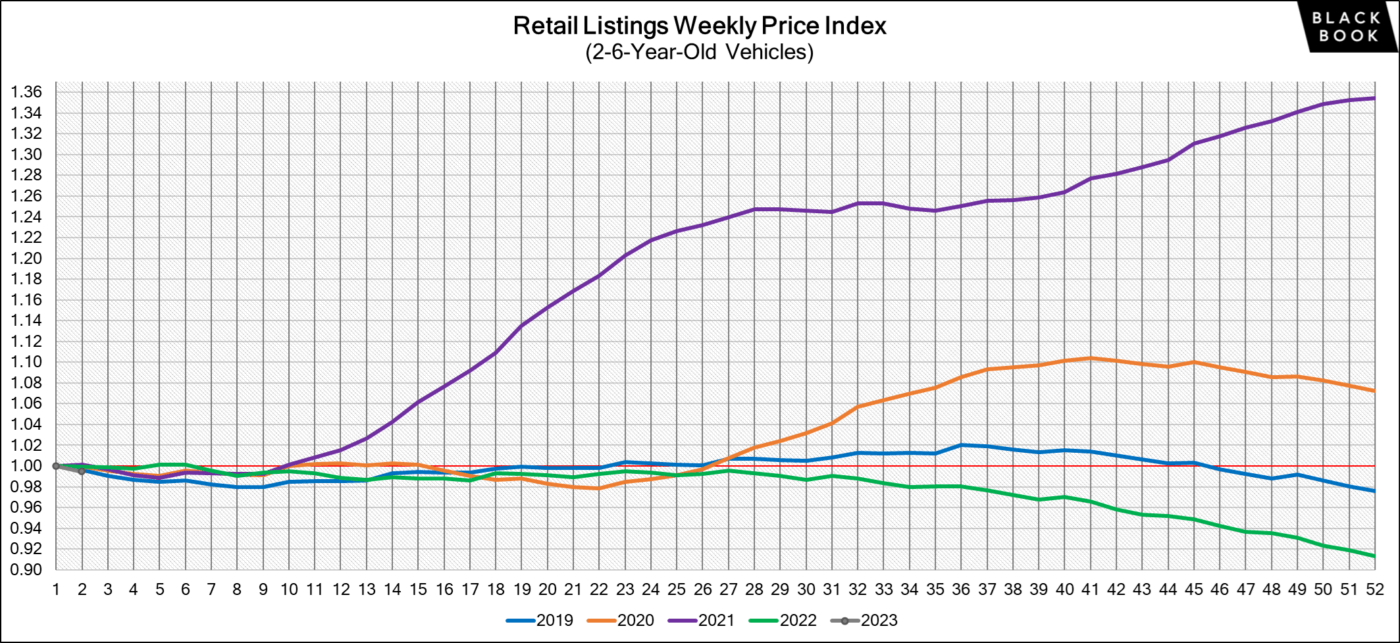

Used Retail Prices

Used Retail Prices are more accessible than in years past, due to the proliferation of ‘no-haggle pricing’ for used-vehicle retailing. Transparent pricing upfront makes the car buying process more enjoyable for customers and allows Black Book to accurately measure retail market trends.At the on-set of the pandemic, in CY2020, used retail prices increased slightly, following typical seasonal patterns, and then began dropping in April, finally hitting a low point in the late spring months. By late summer of CY2020, Used Retail Prices increased as supply of new vehicle inventory started to become scarce, but retail demand slowed down at the end of CY2020, resulting in declining retail asking prices for the last several weeks of the year. When CY2021 kicked off, demand rebounded while retail prices lagged slightly behind wholesale prices; March of 2021 started the dramatic increases in Used Retail Prices, fueled by stimulus payments, tax season, and shortages of new inventory. During the third quarter, retail prices continued to rise at a slower rate but soon picked up the pace once again to start the fourth quarter. In Q4, prices on retail listings steadily increased week after week. As CY2021 came to an end, the retail listing price index closed 36% above where the year began. The index has remained relatively stagnant through most of CY2022. In the fourth quarter of 2022, the Retail Listings Price Index declines started, but not as steep as the wholesale price index.

This analysis is based on approximately two million vehicles listed for sale on U.S. dealer lots. The graph below looks at 2-6-year-old vehicles. The Index is computed keeping the average age of the mix constant to identify market movements. As we get into the third week of 2023, the index dropped to 0.994 points.

Inventory

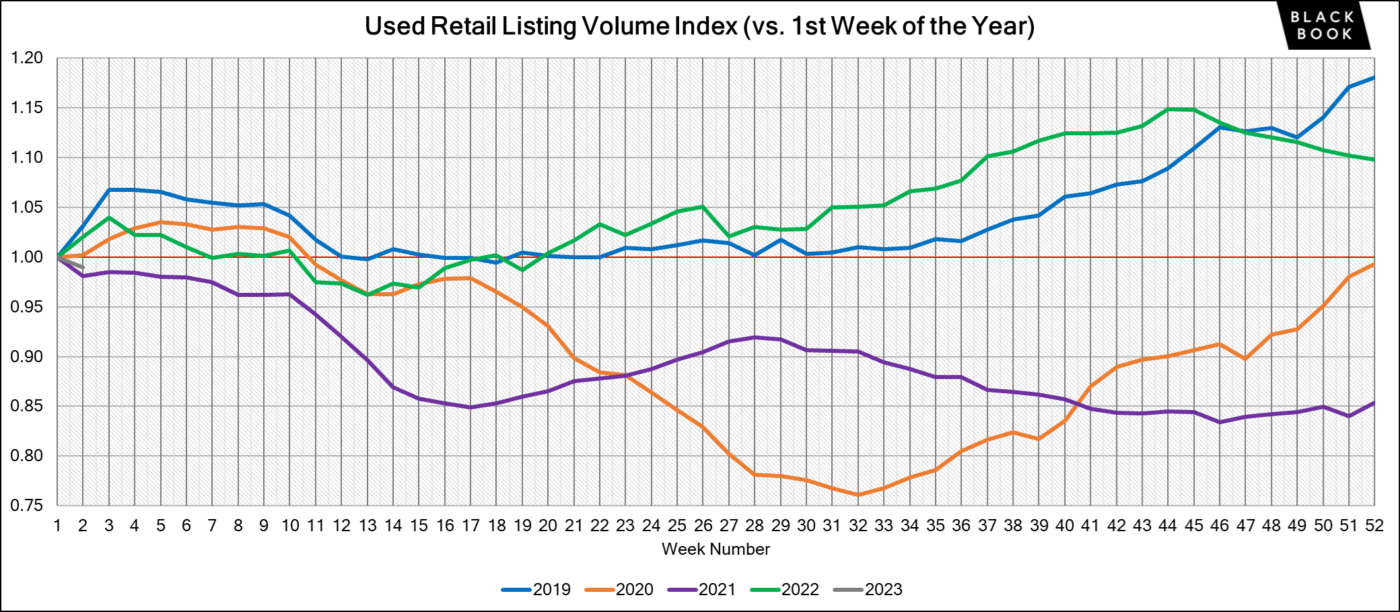

Used Retail

Used retail active listing volume index reverted back to one at the start of 2023. Currently, the index sits at 0.99 points – a slight decline from the previous week.

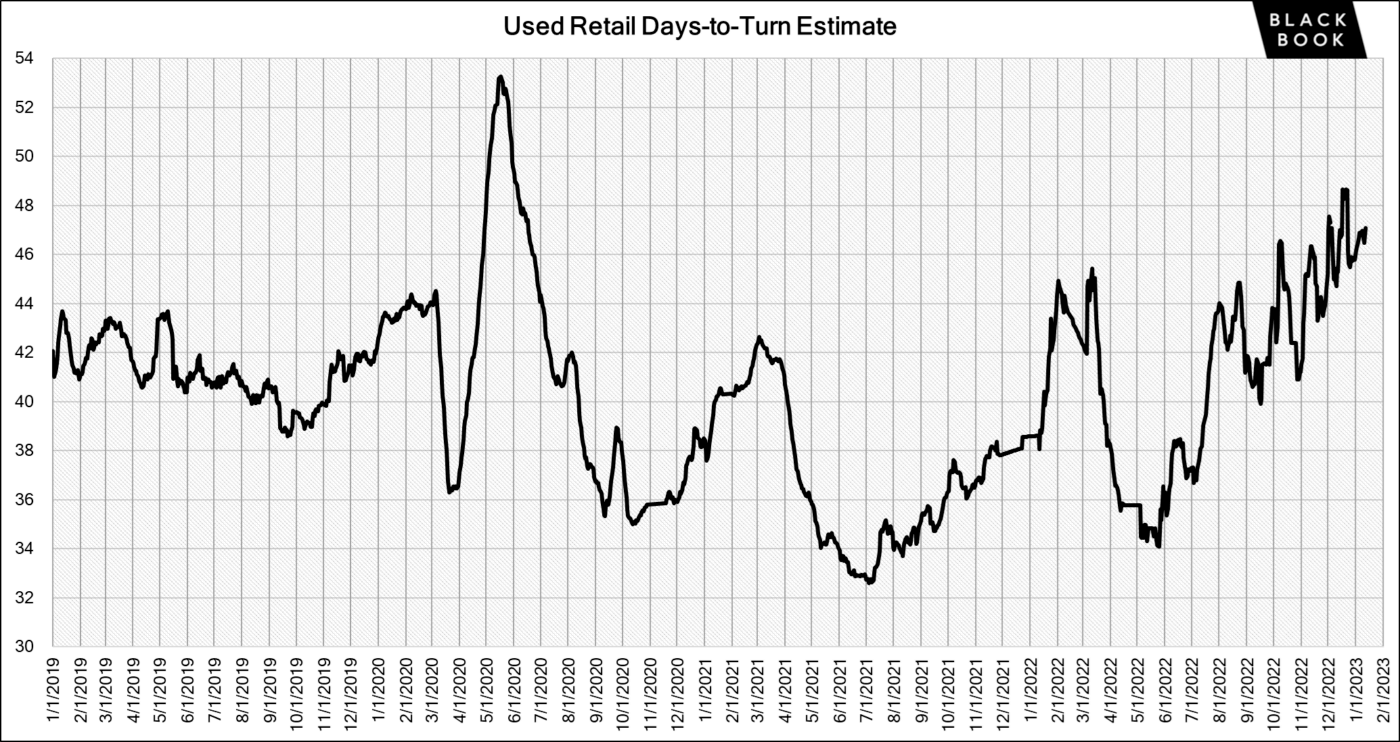

The Used Retail Days-to-Turn estimate is around 47 days.

Wholesale

Inventory at the auctions remains lower than typical, but despite conversion rates remaining flat, the overall sentiment at the auction was more positive last week. The big news heading into this week will be what happens to used Tesla values after Tesla shocked us all with their announcement of price reductions, some models dropping as much as 20% last week. Used electric vehicle values were already feeling the pressure before this news of the price reduction. Values for EVs soared earlier last year, when fuel prices were high but have fallen hard recently as fuel prices have come back down and interest rates have gone up, making those higher MSRPs compared to their equivalent ICE vehicle harder to afford.

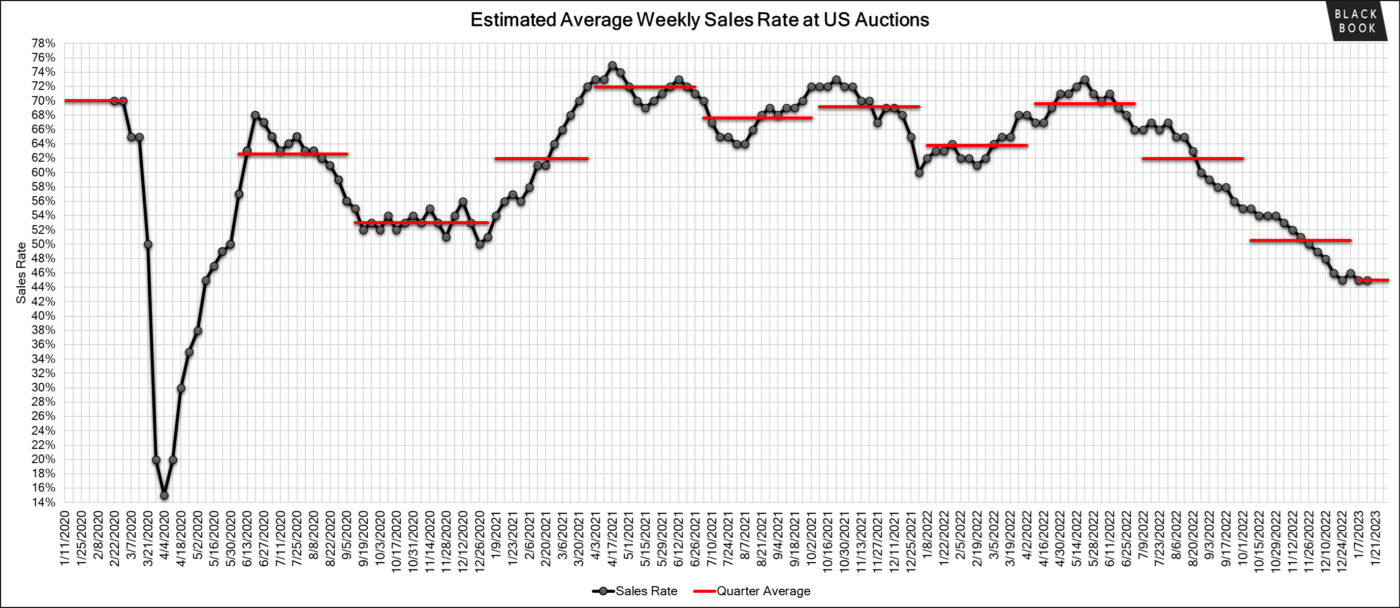

The Estimated Average Weekly Sales Rate came in at 45% last week.

The Estimated Average Weekly Sales Rate came in at 45% last week.

Originally posted on F&I and Showroom

Car Segments

Car Segments