A Micro-Chip Shortage Will Impact Supply – Does it Have to Disrupt the Consumer Shopping Experience Too?

The shortage will make accurate incentives and rebate setting more challenging for the manufacturers. In turn, dealers will struggle with how to set prices and payment offers as a result.

As we’re about to enter year two of the COVID-19 pandemic, the auto industry is facing a continued production and supply challenge stemming from the pandemic, but not because factory workers are being told to stay home.

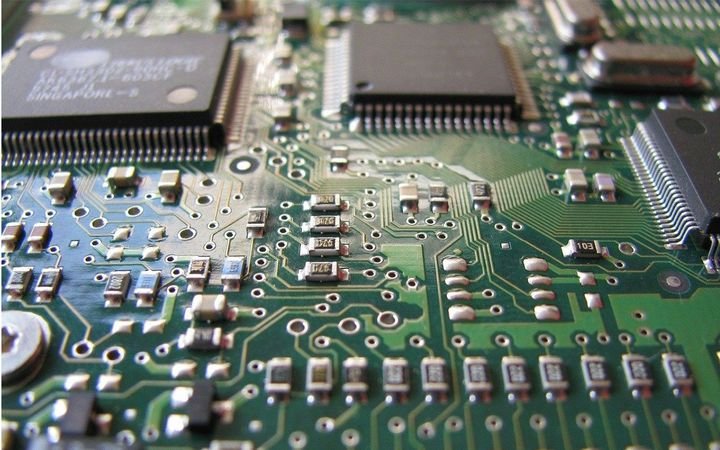

The chips are used in everything from engine management systems, bluetooth, road navigation and collision-detection systems, and – remarkably – they can comprise as much as 40% of a new car’s cost.

This time around, a shortage of semiconductor chips, which are also used to build other consumer electronics in high demand, are causing supply backlogs for the production of new vehicles.

The Latest on Semiconductor Chip Shortage

Semiconductor chips today are a critical part of the vehicle build process. The chips are used in everything from engine management systems, bluetooth, road navigation and collision-detection systems, and – remarkably – they can comprise as much as 40% of a new car’s cost, according to Deloitte1.

Research firm, AutoForecast Solutions, recently increased its estimate of the number of cars and trucks that will not be produced because of these supply problems.

Globally, the forecasting firm said that the automotive industry had already announced volume cuts totaling 680,350 vehicles — up from 202,000 vehicles in January. The firm also believes that number may increase to 1,321,701, as additional auto plants and their supply partners run out of chips; as many as 338,822 vehicles are expected to fall out of North American production plans2.

How a Chip Shortage Affects Car Shopping

The shortage will make accurate incentives and rebate setting more challenging for the manufacturers. In turn, dealers will struggle with how to set prices and payment offers as a result. Finally, for consumers it can be expected that the shortage of supply will result in increased MSRPs.

Even before the pandemic and chip shortage, one of the major concerns among consumers was their inability to shop for a car online and seamlessly complete the transaction at the dealership. Consumers simply don’t understand why the monthly payment they were quoted online is different when they get to the store.

In fact, a recent survey we conducted revealed that 43% of consumers are frustrated that their online offer is different from what they are presented with at the dealership. This is important because 21% of shoppers say they walk away from a deal when this discrepancy is $50 or more per month; this number quickly jumps to 48% when the difference between what is quoted online and in the store is $75 a month.

For dealers who are not using technology solutions that empower them to provide identical price quotes online and in the store, nearly half of their car shoppers will walk away because the payments offered at the store are different from what they were offered online!

How Will Chip Shortages Impact Manufacturers’ Incentive Programs

Payments quoted to consumers are often shaped by manufacturer incentives and rebates, and the new chip-driven supply challenges will only exacerbate the inexact science manufacturers use in determining these.

Manufacturers spend billions of dollars each year on incentives to move inventory to achieve a desired market penetration. Traditionally, the car makers go through a labor-intensive process to analyze the data related to the effectiveness and impact of the incentive and rebate programs they are offering. This is done to determine how best to position themselves competitively – and to determine how much they have to spend to earn their desired market share.

The process is time consuming, mechanical and unsophisticated. Decisions are often made on gut instinct – without having all of the facts. Not only is this very expensive (and seldom accurate), it is also not timely and provides openings for competitors to step in and win market share.

Almost every dealer in the country has experienced an inability to collect rebate and/or incentive monies from their manufacturer because of the misapplication or improper combination of rebates. When this happens there are two options: Rewrite the contract, which always upsets the customer, or take the difference out of the gross.

The data and technology platforms needed to overcome this are available, all of which will greatly enhance the customer experience. Manufacturers, lenders and dealers can now be seamlessly tied together in a complete system that offers a portal and a dashboard containing all pertinent data necessary to build, offer and transact. This technology includes a solution that mines, analyzes and manages the billions of combinations and iterations of all lender and manufacturer programs available in the marketplace and finds truly superior, scientifically perfect solutions for all stakeholders: consumers, dealers, lenders and manufacturers.

Furthermore, today’s best and most comprehensive solutions enhance the consumer experience and the showroom process by electronically presenting all payment and purchase options to customers with full compliance and transparency – on any computer, tablet or mobile device – at any/all points along the consumer’s shopping journey. As a result, the process can dramatically shorten transaction times, raise dealership efficiencies and margins, and elevate customer satisfaction as a result of a more streamlined process.

With these new technologies available to the entire automotive eco system, all parties involved can quickly adapt to changes caused by a disruption to supply – without compromising the optimal shopping experience for the customer.

Rusty West is President and CEO of Market Scan Information Systems.

2: https://www.autonews.com/manufacturing/new-forecast-13-million-vehicle-loss-microchip-shortage

Originally posted on F&I and Showroom