A fight over the future of electric vehicles is unfolding in Washington. Canadians are involved

A struggle is unfolding in Washington over who will make the electric vehicles that the Biden administration sees as a key part of the transition to a carbon-neutral economy.

And some Canadians are taking sides in the debate with long-term implications.

The specific flashpoint is the landmark Inflation Reduction Act, and the large tax credits it offers American consumers for buying an EV.

The U.S. government is now writing the rules to implement this law, arguably the biggest legislative achievement of the Biden era.

The clash, in a nutshell, revolves around a question: What is the main goal here?

Is it to sell more electric vehicles, more quickly, speeding the transition to a low-carbon economy?

Or is it to achieve the slower, steadier re-industrialization of North America — one that would reduce long-term reliance on China and draw manufacturing here as part of what the White House has taken to calling Bidenomics (new window)?

That debate is playing out as the U.S. Treasury Department studies public comments while designing its tax credits — which are worth up to $7,500 (new window) per car.

Canadians might remember this issue. It was a sore spot (new window) between Ottawa and Washington until an amicable resolution, with the law ultimately (new window) giving North American products preferential treatment.

A worker at the Jinyuan Company pours a rare earth metal into a mould in China’s Inner Mongolia Autonomous Region in late 2010. At that time, China halted shipments to Japan amid a territorial dispute. (David Gray/Reuters)

Photo: (David Gray/Reuters)

Now the rest of the world wants in on that deal. Other countries (new window) and importing companies have been fighting to make their products eligible for those tax credits, and are arguing for an expansive interpretation of the law.

Their argument is both environmental and practical. They say meeting climate goals requires a rapid electrification (new window) of the vehicle fleet and there’s no way of getting there if the rules are so protectionist that virtually no cars qualify (new window) for tax credits.

The counter-argument invokes national security.

In short: Western countries are disturbingly dependent on China for industrial inputs that power our economy, like critical minerals, and this law is supposed to change that.

Amid a manufacturing renaissance in the U.S., this argument goes that the U.S. can’t count on China for its inputs.

Public commenters include Quebec

The Treasury Department released an interim draft (new window) this spring and gave everyone until June 16 to weigh in on a series of highly technical judgment calls it needs to make.

Such judgment calls involve the definition of a trade agreement, whether leased cars count as commercial vehicles (which qualify easily (new window) for the credit), which minerals deserve protections and how to calculate the value of battery parts.

In aggregate, these seemingly eye-glazing dilemmas hold serious implications for everything from the environment, to U.S. alliances and to national security, according to public comments submitted to the Treasury.

Among those urging the regulators to get stricter are the Quebec government and a company based in B.C. and Quebec. Both have expressed concern (new window) in their submissions (new window) that the proposed rules are too permissive.

It’s a plot twist from a year ago, when Canadians were fuming the law was too strict — back when Canada feared being shut out of the credits entirely.

Canadian battery-technology manufacturer Nano One Materials Corp. argues that the draft regulations are too broad. One complaint, for instance, is that the law needs stricter rules for iron.

Iron makes up one-third of lithium iron phosphate (LFP) car batteries. The company says it needs the same protections as critical minerals, otherwise these U.S. tax credits will wind up subsidizing batteries mostly produced in China.

‘A big loophole’

To me that’s a big loophole. And it needs to get resolved,

Nano One CEO Dan Blondal told CBC News.

We will be funnelling tax dollars to our competitors overseas.

LFP technology reflects the history of electric vehicles.

Decades ago, it was actually developed partly in Quebec (new window), including by publicly funded institutions — Hydro-Québec and the Université de Montréal.

But the technology never took off here. It eventually wound up being mass-produced in China (new window) and patent fees were waived for Chinese companies (new window) producing domestically. Now those patents are expiring (new window) right as LFP is gaining in popularity.

Nano One starts production this year in Candiac, Que., after building partnerships (new window) with mining giant Rio Tinto, Volkswagen and energy-storage company Our Next Energy.

Blondal calls the Inflation Reduction Act a rare chance to ease dependency on a rival, China, that once famously cut off mineral exports (new window) to Japan during a dispute.

We have … a generational opportunity,

Blondal said. Otherwise we’ll lose on national security. We’ll give away jobs and we’ll perpetuate many of the environmental issues and GHG emissions … that are kind of the antithesis of our net-zero ambitions.

Quebec also argues in its submission (new window) that the rules, as currently written, risk further entrenching U.S. dependency on unreliable countries with state-funded companies — an unstated allusion to China.

Enlarge image (new window)

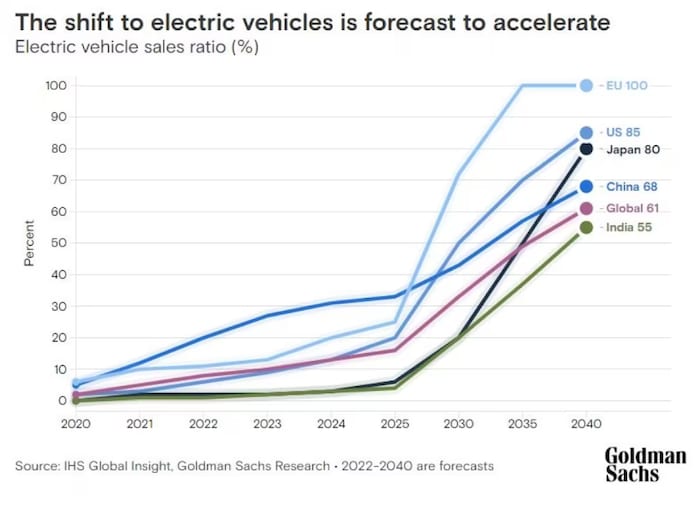

Enlarge image (new window)The shift to electrical vehicles.

Photo: IHS

Their position has allies.

The U.S. domestic mining lobby (new window) warned in its submission (new window) that rivals have a stranglehold on industrial minerals and China will continue to control 70 per cent of the battery supply chain through 2030.

The National Mining Association argued the Biden administration’s current draft regulations are inconsistent with the legislation’s goal of reversing this trend.

Implement [this law] to support the domestic sourcing goal of Congress rather than finding ways to undercut it,

the association said.

That get-strict approach has a high-profile endorsement, from no less than the U.S. senator who provided the critical swing vote that passed the law.

Among those submitting comments was Sen. Joe Manchin, who negotiated many of the key provisions of the bill before he let it pass.

In a signed letter, he listed several ways the Biden administration strayed, in his opinion, from the intention of the law.

Manchin: ‘Follow the law’

He argues leased cars shouldn’t count as commercial vehicles. He says Biden stretched the definition of free-trade agreements to include a critical-minerals deal signed with Japan (new window), and another he’s working on signing with Europe (new window).

And he fumed that, under a proposed phase-in period of at least two years, tax money can go to batteries where as little as 25 per cent meet Manchin’s intended conditions.

My comment is simple,

Manchin wrote at the tail end of an 11-page letter (new window) filled with technical complaints.

Follow the law.

The counter-argument from the administration is that the law isn’t always clear. There’s a judgment call involved, like what counts as a commercial vehicle.

The climate counter-argument

Advocates of the more generous application of tax credits cite the urgent threat of climate change.

They say it’s going to be a challenge hitting the U.S. Environmental Protection Agency’s goal of EVs accounting for two thirds (new window) of light vehicles sold in the U.S. by 2032.

The U.S. will fall slightly short of that, according to private-sector forecasts by IHS and Goldman Sachs (new window) and others (new window).

The policy design matters. EV projections vary (new window), in part, on what sorts of incentives get adopted by government, including in the Inflation Reduction Act.

Some carmakers, like Stellantis (new window), urged the administration to stay the course, and produce final rules as flexible as the draft version.

A lobby group (new window) for big international auto companies that also manufacture inside the U.S. said it applauded the flexible attitude in the draft regulations.

[This approach] will help more Americans better afford the transition to a clean vehicle of their choice,

wrote Autos Drive America.

The final rule should be out soon.

Then there’s another, related, battle ahead. Starting next year, the Inflation Reduction Act forbids tax credits going to batteries produced by a so-called foreign entity of concern (new window).

Smoke from Canadian forest fires hovers over New York City this week. The climate crisis is one reason for looser rules in the tax credits, argue advocates for selling more electric vehicles, more quickly.

Photo: Reuters / SHANNON STAPLETON

Those details still need to be defined.

So it’s unclear what that incoming rule will mean for carmakers, inside the U.S., that buy batteries from the Chinese giant CATL.

For example, Ford (new window) is partnering with CATL to produce in Michigan; Tesla already buys (new window) CATL batteries and is reportedly (new window) considering a U.S.-based joint deal like Ford’s.

That uncertainty looms over the industry. In the meantime, the smaller Canadian battery company, Nano One, says it’s watching closely.

Alexander Panetta (new window) · CBC News